Almost 1.2 million B-SUV sold globally in 2016-Q1. More growth is expected

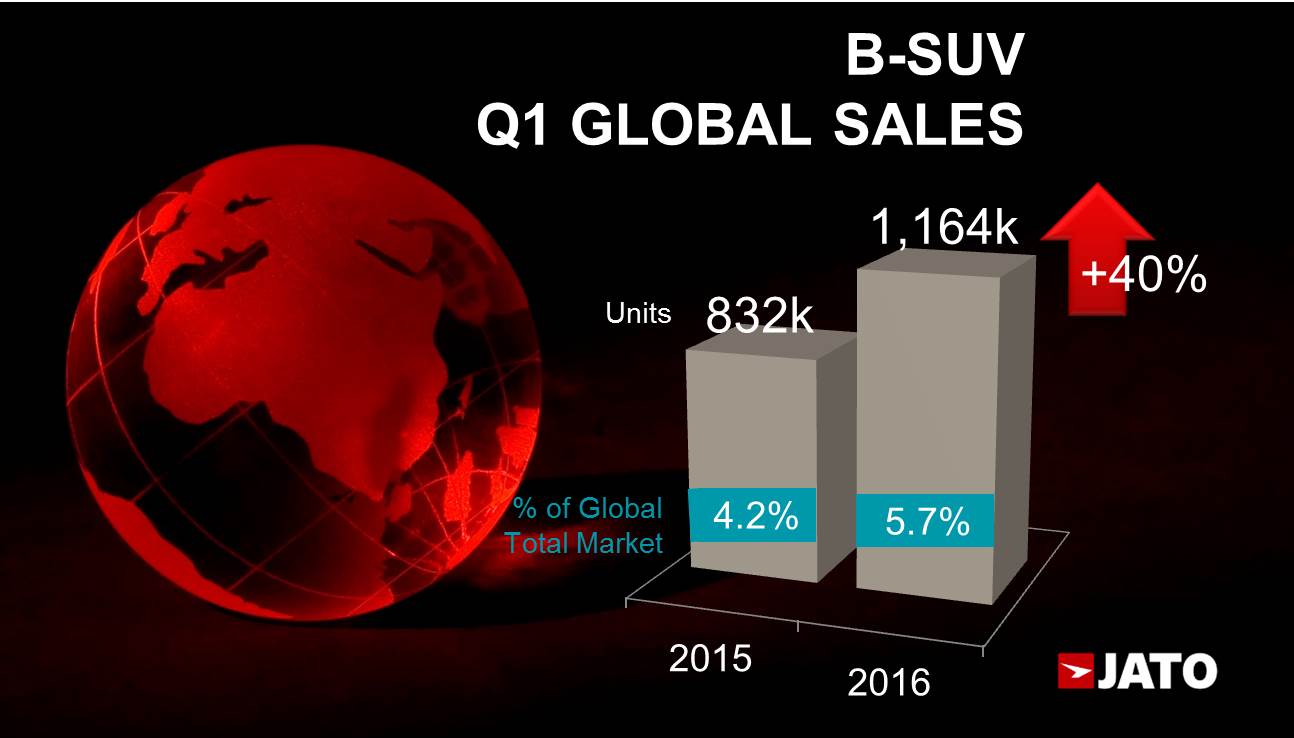

Small SUVs posted a 40% growth during the first quarter of this year to 1.16 million units in the whole world. This strong growth is explained by double-digit increases in all regions, except in Japan-Korea. The volume grew by 24% in Europe, the world’s largest market for the B-SUV, and 51% in China-Taiwan, getting at only 15,000 units behind Europe. The biggest jump was recorded by North America, where the baby SUVs demand soared jumping from 49,000 units in 2015-Q1 to 113,000 units in the first quarter of this year. Japan-Korea was the sixth largest market but the volume grew by only 3% to 60,100. This market was outsold by India, where sales went up by 37%. South America’s overall drop was not an excuse to stop the SUV boom. Volume grew by 66% allowing the B-SUVs to gain share from 4.3% in 2015-Q1 to 8.9% in 2016-Q1.

Small SUVs posted a 40% growth during the first quarter of this year to 1.16 million units in the whole world. This strong growth is explained by double-digit increases in all regions, except in Japan-Korea. The volume grew by 24% in Europe, the world’s largest market for the B-SUV, and 51% in China-Taiwan, getting at only 15,000 units behind Europe. The biggest jump was recorded by North America, where the baby SUVs demand soared jumping from 49,000 units in 2015-Q1 to 113,000 units in the first quarter of this year. Japan-Korea was the sixth largest market but the volume grew by only 3% to 60,100. This market was outsold by India, where sales went up by 37%. South America’s overall drop was not an excuse to stop the SUV boom. Volume grew by 66% allowing the B-SUVs to gain share from 4.3% in 2015-Q1 to 8.9% in 2016-Q1.

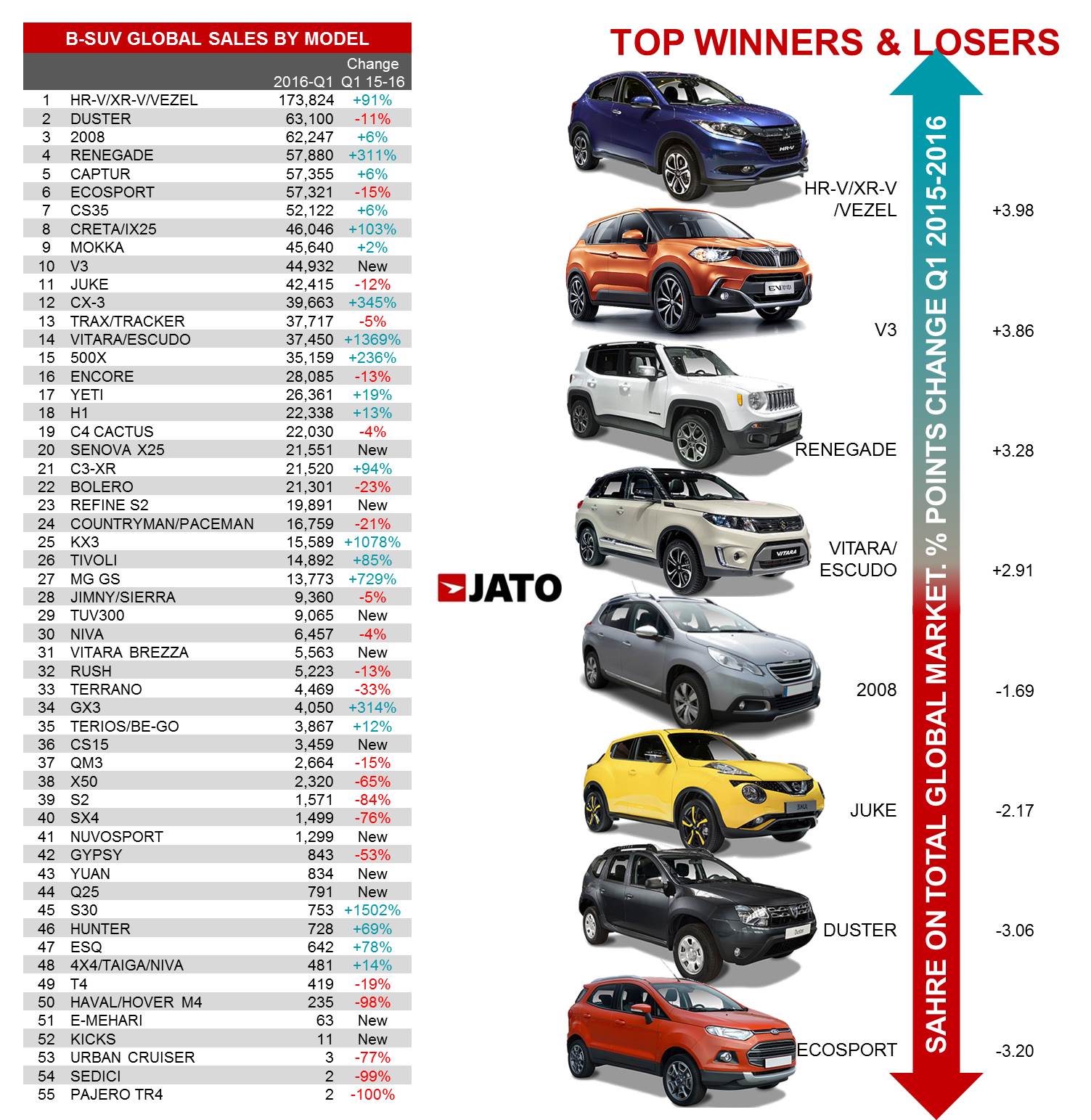

The good results of this segment were mostly used by Honda, FCA and Hyundai groups as their segment share soared. Honda became the top-seller in the segment jumping from the fourth to the pole position with 14.9% share. Thanks to the popular HR-V (aka Vezel or XR-V), the Japanese car manufacturer outsold PSA, GM and Renault-Nissan, which lost its first place. FCA was another big gainer which benefited from the success of its Jeep Renegade-Fiat 500X couple. The Italian-American car manufacturer became the world’s fifth largest B-SUV maker outselling other big ones such as Ford. Notice that the world’s two largest car manufacturers – Volkswagen Group and Toyota – were quite down in the ranking. The Chinese car manufacturers controlled 16.2% of the segment.

The good results of this segment were mostly used by Honda, FCA and Hyundai groups as their segment share soared. Honda became the top-seller in the segment jumping from the fourth to the pole position with 14.9% share. Thanks to the popular HR-V (aka Vezel or XR-V), the Japanese car manufacturer outsold PSA, GM and Renault-Nissan, which lost its first place. FCA was another big gainer which benefited from the success of its Jeep Renegade-Fiat 500X couple. The Italian-American car manufacturer became the world’s fifth largest B-SUV maker outselling other big ones such as Ford. Notice that the world’s two largest car manufacturers – Volkswagen Group and Toyota – were quite down in the ranking. The Chinese car manufacturers controlled 16.2% of the segment.

Model wise, there is no small SUV able to beat the popular Honda HR-V. Due to the drops recorded by the usual old leaders such as the Duster (Renault and Dacia), and the Ford Ecosport, the small Honda managed to increase its segment share from 10.9% to 14.9%, and therefore to increase the gap with the second in the ranking. The Honda proved to be a success in China, Southeast Asia, USA and Brazil, whereas it was not able to gain an important position in the European ranking. Its sporty and cool design along with a Crossover style has allowed this model to conquer a big part of the world’s B-SUV market. The HR-V was followed by the Renault/Dacia Duster, which is already suffering the consequences of its high age. Its volume fell by 11% as a consequence of a weak demand in Europe (where it reached its maturity commercial phase) and drops in South America and India.

The Peugeot 2008 was the third best-selling B-SUV but its volume grew by only 6% due to an 18% drop in China, its second largest market after Europe. The other big event during the quarter was the fourth position occupied by the Jeep Renegade, whose sales counted for almost 5% of the B-SUV segment, with volume jumping from 14,000 units to 58,000 units in 2016-Q1. The Renegade has been able to open the doors of the European market to Jeep, and give some visibility to small SUVs in North America. It also became FCA’s source of good news in the troubled Brazilian market. Its numbers should be boosted by its localization in China during the first half of 2016. The top 5 was completed by the Renault Captur, but as it happened to its domestic rival – Peugeot 2008 – its sales grew by only 6% due to its stagnation in Europe, its largest market (95% of the total).

The Peugeot 2008 was the third best-selling B-SUV but its volume grew by only 6% due to an 18% drop in China, its second largest market after Europe. The other big event during the quarter was the fourth position occupied by the Jeep Renegade, whose sales counted for almost 5% of the B-SUV segment, with volume jumping from 14,000 units to 58,000 units in 2016-Q1. The Renegade has been able to open the doors of the European market to Jeep, and give some visibility to small SUVs in North America. It also became FCA’s source of good news in the troubled Brazilian market. Its numbers should be boosted by its localization in China during the first half of 2016. The top 5 was completed by the Renault Captur, but as it happened to its domestic rival – Peugeot 2008 – its sales grew by only 6% due to its stagnation in Europe, its largest market (95% of the total).

Other winners included the Brilliance V3, Suzuki Vitara, Mazda CX-3, BAIC Senova and Fiat 500X. In the opposite side the biggest market share losers were the Ford Ecosport, Renault/Dacia Duster, Nissan Juke, Peugeot 2008, Renault Captur and Chevrolet/Holden Trax/Tracker.

Forecast

This segment is expected to continue growing because of two main reasons: the traditional leaders will get a deep update or new generations, and more volume will hit the Indian, Russian and South American markets. Meanwhile US B-SUV market will get more players that will try to follow the Jeep Renegade and Honda HR-V success. Europe and China will still post big increases boosted by the updated Captur, 2008, the Mokka X, and by the arrival of the new generation Dacia Duster. Actually our LMC Automotive partner forecasts a continuous growth for European volumes till the year 2020, when the B-SUV sales will total 1.93 million units, or 11.4% of total European market. In 2016-Q1, the B-SUVs counted for 8.2%. Part of the growth will also come from the late arrival of VW Group in the segment with its trio VW Polo SUV, Skoda Fabia SUV and Seat Ibiza SUV.