Chinese car consumption keeps upgrading, along with the growth of luxury car market

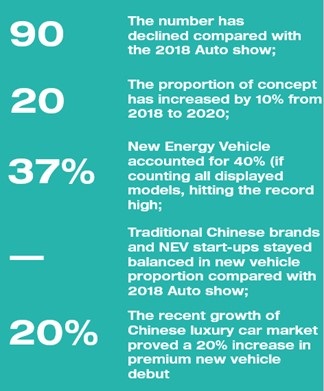

Auto China 2020 was the first major trade show for the automobile industry since the pandemic began – below is a summary of the headline numbers from this event.

The show in numbers

- 90 new models

- 20 concept cars – a lower number than 2018, but a higher proportion of total new models

- New energy and new vehicles accounted for 37% of all new vehicles

- The proportion of new vehicles from Chinese brands remained the same as seen in 2018

- The proportion of new vehicles from luxury brands increased by 20%

Chinese market trends

Car buyers are getting younger

Throughout the show it was clear that an increasing number of OEMs focused on fashionable product features of vehicle models, outside of the latest technology. Many exhibitors also chose not to conform to traditional dress code (i.e. business attire), instead wearing more casual clothes to appeal to younger consumers. Brand Director of SAIC-GM Cadillac Zhen Liu said that nearly 50% of consumers purchasing Cadillac models are now under 35, and Cadillac’s female consumers account for 33% of all sales. Additionally, Changan Auto mentioned that consumers born between 1990 and 2000 made up 55% of UNI-T’s consumers – a significantly higher percentage than previously seen for traditional Chinese brands.

Industry experts pointed out that Gen Z consumers (those born between 1995 and 2009) have become the main demographic of car buyers. They pursue fashionable trends, are keen on highlighting their personality, and are receptive to new technologies. Therefore, features such as flamboyant design, high-end specifications, and the latest tech applications (as well as brand stories) are guiding a new direction of both car design and marketing strategy.

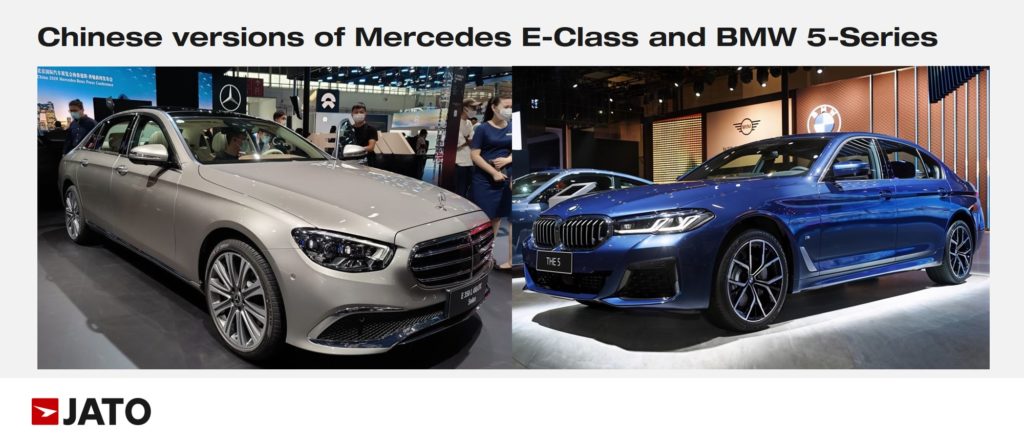

With increasing disposable income and personal wealth, China is transforming from the ‘world’s factory’ into a fast -growing consumer market. Luxury brands have been quick to jump on this. For example, BMW and Mercedes-Benz – both presented new versions of their key models at the Autoshow. These models were the BMW 5 Series facelift and the Mercedes-Benz E facelift. Their exterior design, interior atmosphere, power and detailed embellishment all cater to the desires of the younger generation.

The BMW 5 Series facelift adopts a design style similar to that of the new 3 Series- double L-shaped daytime running lights, combined with laser headlights, it heavily improves both the look and its functions. The entire vehicle highlights its sportiness, with a lower front face and sharper body line. Moreover, the vehicle has better technological capabilities, adopting iDrive IoV (Internet on Vehicle) and featuring a larger-sized screen.

The Mercedes E facelift also featured new headlights in an iconic shape. The new blackened LED tail lights draw on the new S-class design elements, with excellent visual effects. Consumers are able to choose either a standard or sport version. The Mercedes E facelift adopts dual 12.3-inch large screens and an upgraded MBUX vehicle system to present a better user experience. In a nutshell, despite few specification changes, this vehicle can be used for either business or personal purposes – the whole interior providing a simultaneously classy and technological feel. BMW and Mercedes’ new designs will undoubtedly push other brands to focus more on younger consumers, given the fact that they are now the lifeblood of the automotive industry.

Great Wall Motor (GWM) is the most striking of the traditional Chinese brands.The brand displayed several new vehicles with interesting names including the HAVAL Big dog, the Ora Good cat and the H2 First love – all aimed at the younger generation. The Haval Big dog is targeted at consumers who require both urban and off-road SUVs; the Ora Good cat is mainly targeted at young female drivers in urban areas; and the Haval H2 First love is positioned as an entry-level compact SUV – a first car for younger people. Not only was GWM creative in the naming of its new cars, it also launched multiple interactive marketing campaigns both on-and-offline to gain consumers’ attention and increase exposure.

Diversification of market

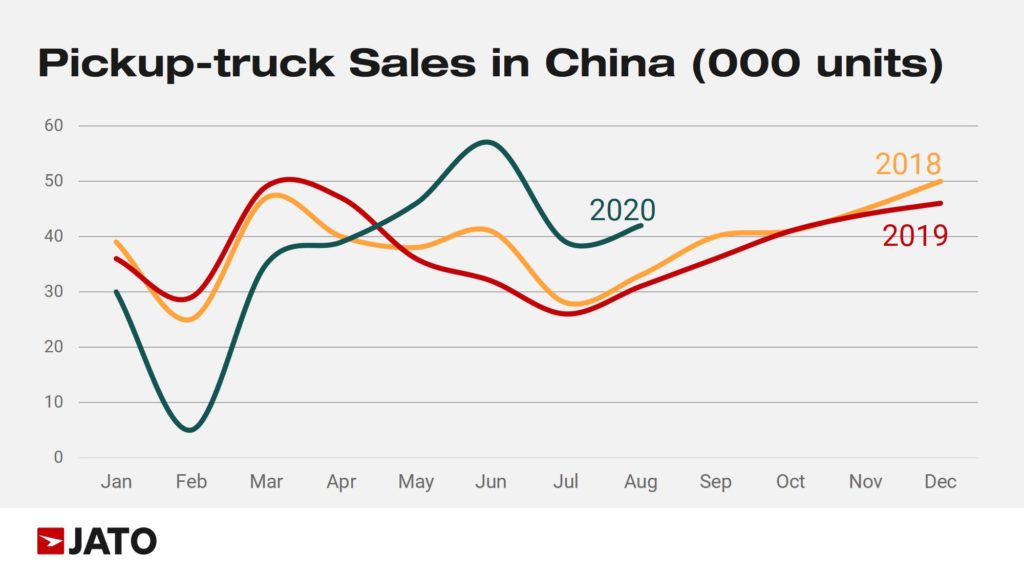

The automotive industry is becoming diversified in terms of both product development and segmentation. The SUV and pickup segments are likely to generate high-end product strategy, reflected in the larger body size and higher price range. New vehicles have been displayed among major pickup brands such as GWM, JMC, JAC, MAXUS and FOTON. Pickup is a new area attracting attention due to merged opportunities with the trend of restrictions loosening in urban areas as well as the consumption upgrade. According to the most recent data from CAAM, the pickup market saw a significant decline in sales at the beginning of the year due to the impact of the COVID-19 pandemic. However, as the pandemic stabilized, the market quickly recovered and sales have returned to the same level as this time last year. It is expected that the market will see stable growth throughout the year and become one of the few market segments to show growth in the declining automotive sector.

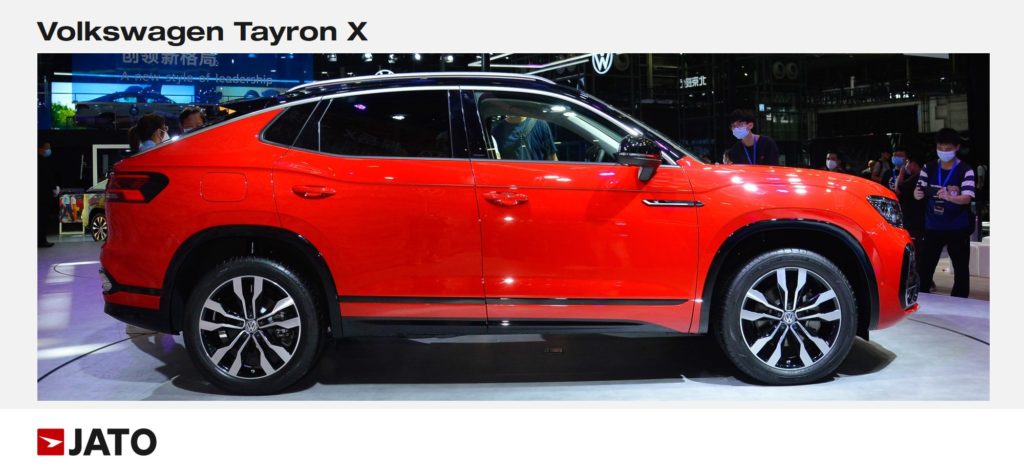

Another prominent aspect of market diversification is that niche and personalised vehicles have achieved great attention in recent years.

If we look at several vehicles at a glance, Audi brought the world premiere of Q5L Sportback, as well as its China debut with RS Q8, R8 Coupe and RS 5 Sportback. Volkswagen launched its SUV coupe series the Tiguan X/Tayron X, and BMW displayed its M3, M4 and M5. Hongqi also launched customised models H9+ and HS7+.

Chinese brands seek breakthroughs

Although the overall environment for the passenger car market in 2020 H1 did not get off to the best start, traditional Chinese brands have still maintained a relatively stable market share. Chinese OEMs have launched high-end brands and have achieved positive results. Recently, Hongqi witnessed growth against the downward trend, with its sales exceeding 100,000 units from January to August 2020. It is likely that its sales will reach nearly 200,000 units this year. Other product upgrade examples include Chery – who continues to strengthen its Exceed product line; Dongfeng who has sped up their R&D in new mid-high level brand VOYAH; and Changan who is planning to build another mid-high level brand in the coming months.

The above move of traditional Chinese OEMs has posed a threat towards some foreign brands, such as Hyundai, Kia, Citroen and Peugeot. Yueda-Kia’s sales have continued to decline in recent years with sales in 2019 only half of those recorded in 2016. With the pressure coming from the declining auto market and traditional Chinese brands, the CEO of Dongfeng Yueda-KIA told a reporter that the company will focus on ‘TECH’ strategy (Turbo, Electrification, Connectivity and Hybrid) and pursue product differentiation..

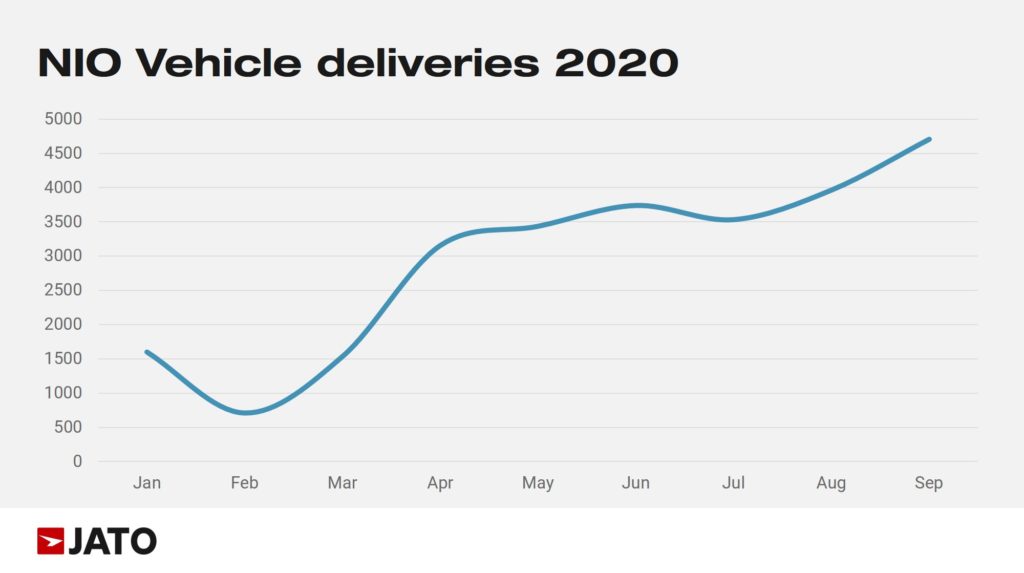

In terms of electrified vehicles, NEV start-ups have made considerable progress. NIO resolved its cash flow issues in 2019 and is back on track. NIO produced 4,708 vehicles in September and a total of 12,206 vehicles in the first three quarters of 2020, which sets the record high. Additionally, Xpeng and LEADING IDEAL performed well in terms of sales during the same period.

Chinese brands that are keen to export to European market SAIC MG electric passenger cars and BYD electric buses have both entered into European markets and gained recognition. AIWAYS recently signed a cooperation agreement with European car leasing operator Filippi Auto, and will deliver bulk customised AIWAYS U5 European models in France. This means that AIQAYS is the first Chinese startup car company to export smart electric vehicles to the EU.

Car technology trends

The NEV trend remains unchanged

The industry remains laser focused on EAC (Electric, Autonomous and Connected).

Since the beginning of this year, the Ministry of Industry and Information Technology of China and the State Council have successively issued new guidance intended to relax industry entry barriers, stimulate industrial investment, encourage R&D investment, sales and consumption of NEV and improve market growth.

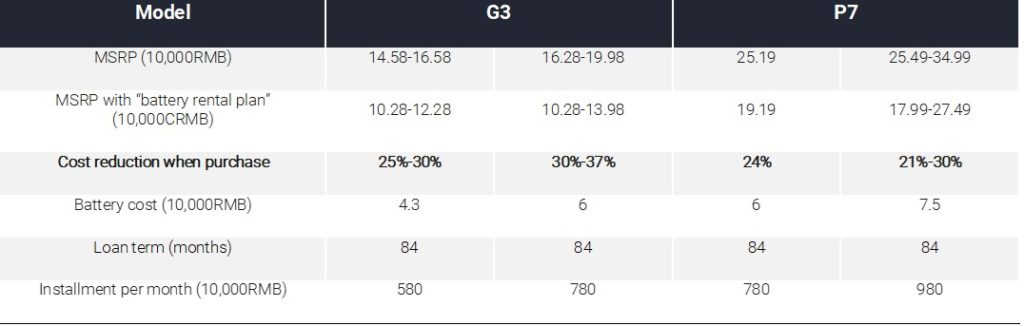

Across the Chinese EV market, leading brands continue to develop new business models and continue to disrupt and drive change across the whole market. One such example is the emergence and development of the “battery rental model” (NIO called it BaaS, Battery as a Service). This battery leasing service allows drivers to buy an EV without owning the battery pack – one of the most expensive EV components – thereby lowering the starting price of its cars.

During the Autoshow, NIO put a battery replacement station on its stand to highlight its automated BaaS operations and ahead of the show, it also launched its new purchase plan.

The battery rental plan released by Xpeng in Autoshow:

Foreign brands invest more in NEV

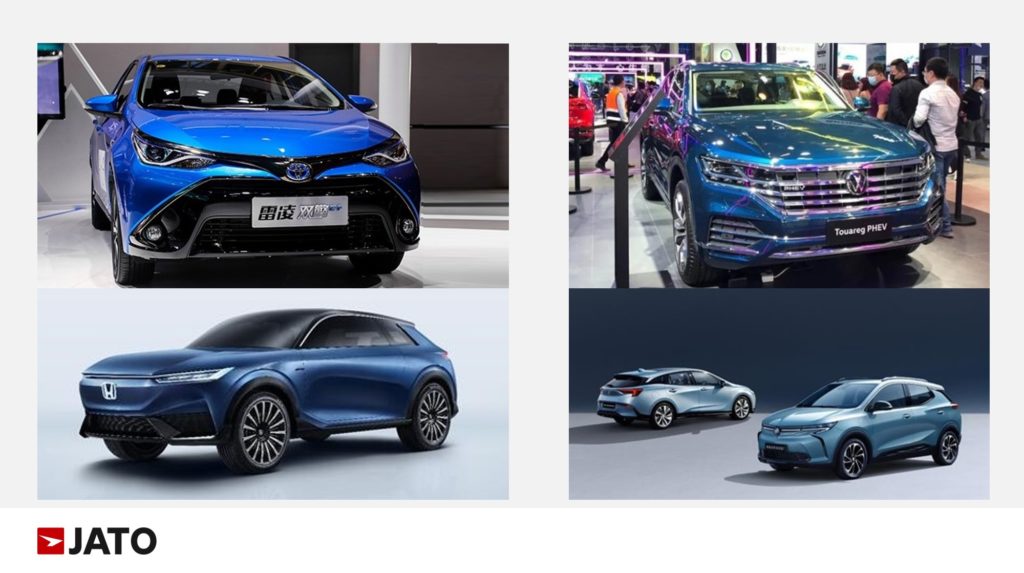

It is also worth noting that the mainstream foreign brands have also increased investment in NEV. One such example is Volkswagen – although its ID.4 model did not feature as part of the Beijing Autoshow as scheduled, Volkswagen organized a special new energy model display area at its booth, displaying 5 NEV models: Tiguan L PHEV, Passat PHEV, Tayron GTE, New Magotan GTE and Touareg PHEV. Volkswagen’s recent moves in China, such as the acquisition of battery company Guoxuan Hi-Tech, and the acquisition of JAC Automobile company, are all part of its ambitious implementation plan in the region.

Toyota also displayed six hybrid models, like Avalon PHEV, Camry PHEV, Corolla PHEV, Levin PHEV Sport, RAV4 PHEV and Wildlander PHEV. Along with the production EV models C-HR EV / Izoa E and the FCEV model MIRAI concept, these models form the matrix of Toyota’s NEV models. On the basis of the Accord, CR-V and other hybrid models, Honda made the world premiere debut of its EV model SUV e: concept. Nissan exhibited its electric model Ariya, along with the release of the new brand logo and the launch of “Nissan NEXT” – its strategy specific to the Chinese market. GM displayed new energy vehicles by Buick and Chevrolet brands. Peugeot has plans for its new energy model series and proposed the development strategy of “Move to Electric”. Korean brand Hyundai displayed its mass-produced FCEV model NEXO. Albert Bierman, the President of Hyundai’s R&D Department, presented at the Beijing Autoshow and discussed the global electrification outlook of Hyundai demonstrating its confidence in promoting electrification across the industry.

HEV may have more opportunities

The Energy-saving and New Energy Vehicle Technology Roadmap 2.0, which has been approved by the National NEV Innovation Project Expert Group in Sept. 2020, is expected to be officially released soon. Wang Binggang, head of the Expert Group, declared that China is not likely to have a deadline for banning fossil fuel vehicle sales and hybrid vehicles in China may have more opportunities in the future.

GAC Toyota is going to increase the proportion of HEV to 30% in the coming year. Nissan, Mitsubishi, BMW and Audi also plan to increase their own HEV models and expand sales. Under the circumstance of high BEV cost, fast depreciation and existing mileage anxiety, HEV is likely to gain some market share.In China’s NEV market, mainstream foreign brands have long-term technology accumulation in the HEV field. It has huge benefits in developing HEV models and the largest market share of HEV undoubtedly belongs to them.

FCEV becomes available soon

GAC also brought a FCEV model Aion LX and this model has been in the process of testing in Guangzhou. Additionally, SAIC MAXUS’s hydrogen energy vehicle EUNIQ 7 was also released before the Autoshow. Toyota MIRAI, the frontier of FCEV, was also displayed at the show – an important part of Toyota’s new energy model matrix. Thanks to the improved progress of hydrogen production, storage, and charging infrastructure, FCEV vehicles will be launched and go on sale soon.

Autonomous vehicles and driving are improving

As of 2019, many cities in China have issued road test licenses for autonomous driving. Six cities including Guangzhou, Changsha, Shanghai, Wuhan, Cangzhou, and Beijing have opened road tests with occupants.

Baidu Apollo, a leader in the field of autonomous driving, owns 150 of autonomous driving test licenses, of which 120 allow for tests with occupants. With the support of the policy, Apollo has taken the lead in launching autonomous driving tests in Changsha, Cangzhou, Beijing and other places. Before this Autoshow, Baidu just held the annual Baidu World Conference and demonstrated its latest AI technology and autonomous driving progress through real life simulations. Since the autonomous driving R&D kickoff, Baidu Apollo’s road test mileage has exceeded 6 million kilometers and more than 100,000 people have tried Baidu’s self-driving car. Baidu CEO Robin Li said: “In the next five years, autonomous driving will enter a large-scale commercial phase. At this time, the traffic congestion will be greatly eased and it will be unnecessary to restrict car purchasing and driving in large cities like Beijing. It is expected that in the future, Baidu will continue to expand the scope of road tests and continue to optimize its autonomous driving system.”

During the Autoshow, many OEMs also unveiled their R&D progress in autonomous driving:

Suppliers also demonstrated their technologies and solutions in intelligent driving. Bosch, as a traditional parts supplier and Huawei, as a new entrant, both demonstrated their latest technologies. Bosch’s smart cabin can support multiple display screens, integrate multiple functional requirements, support FOTA of the whole vehicle ECUs and provide life cycle monitoring, diagnosis and data calculation platform solutions. Huawei develops intelligent hardware to realise functions such as communication, perception, recognition, and monitoring. Harmony OS can provide various interactions among users, vehicles and the outside world and improve the riding experience.

It is obvious that cars will become intelligent with more software applications and big data calculations. As a new “energy”, big data will gradually promote the transformation of cars from “horsepower” to “computing power”.

The connected car is the next battleground for OEMs and tech firms

Intelligent network connection will become the next battleground for car companies. Both Chinese and European automobile brands have increased investment on their software teams to strive for breakthroughs in this field. In order to have more space to develop, several software departments have already separated from OEMs and become independent service companies, such as Geely ECARX, SAIC Z-ONE and Toyota Woven.

Industry cooperation is key to unlocking the potential of EACs

On the road to EAC cars (Electric, Autonomous, Connected), when the technical route is still unclear, consumption trends are fast changing and industrial integration continues to occur. More car companies, parts suppliers, ICT suppliers, and service providers will face increased competition but will also have to work together to achieve industry breakthrough. Both cross-border competition and cooperation are necessary for those eager to become a leader in the automotive ecosystem. A number of brand collaborations were launched at the show – for example, BAIC Arcfox and Huawei have formed a “hardware + software” mode; Bosch is collaborating with Tencent; BYD and Mushroom OS have joined forces..

As automotive technology continues to develop at pace, most participants will need to move from “competition” towards “cooperation”.

Key takeouts

- The Chinese market has bounced back in the form of a V-shape recovery ;

- Car consumption keeps upgrading, along with the growth of luxury car market;

- The proportion of NEV has slightly dropped, but the trend of NEV remains unchanged;

- Chinese brands continue to look to expand overseas, with a specific focus on the European EV market;

- The development of EAC Technologies are making solid progress and industry collaboration” is the key to progress