Embracing WLTP: Survive or thrive

With environmental concerns consistently climbing higher on the news agenda, every sector across Europe has set targets for reducing their carbon intensity. As cars are responsible for approximately 12% of the EU’s emissions of carbon dioxide, the automotive industry is a key player on the journey to carbon neutrality.

The reality of climate change has not gone unrecognised in the automotive space, and many are striving to become more efficient, in line with regulations instated to impose emission reduction targets for new cars.

In 2009, the EU created regulation (EC) 443/2009, which established the first emission reduction target to be fully applied for new cars from 2015. This was followed by regulation EU 2019/631 on April 17, 2019, which established CO2 emission performance standards for new passenger cars and vans for 2025 and 2030.

Parallel to these efforts from the EU, the United Nations Economic Commission for Europe (UNECE) created The Worldwide Harmonised Light Vehicle Test Procedure (WLTP) to better measure fuel consumption and CO2 emissions from passenger cars. WLTP complements these regulations by ensuring that test results are more representative of the results that drivers achieve in real work scenarios.

It is those calculations that determine how much road tax a vehicle will be charged. Offering a clear incentive – the lower the emissions, the lower the taxation.

As the world moves towards a cleaner future WLTP can be a key contributing factor on the road to achieving this. However, large segments of the automotive industry are far from meeting these targets, as illustrated last year 2019, when average CO2 emission levels increased for the third consecutive year.

Where politicians and policymakers seek to push through tougher emissions legislation, OEMs, on the other hand, are facing huge operating costs – juggling meeting the demands from consumers for more vehicles, with new CO2 targets. For example, where OEMs have striven to make improvements on their vehicles’ fuel efficiency and technologies, this trend has largely been offset by consumer preference for larger, more fuel inefficient cars, such as SUVs.

Moreover, whilst many consider electric vehicles as the panacea for the future of the automotive industry, there is a long way to go before they provide all the answers. Although we are seeing significant growth in electric vehicle registrations – now accounting for more than 10% in Europe – there are numerous reasons why EVs are unlikely to be significant drivers of change on the road to carbon- neutrality, including their current pricing and affordability.

Indeed, it is clear that, despite positive ambitions, more needs to be done to achieve these goals. It’s therefore imperative that the industry commits to removing the uncertainty surrounding WLTP if they are to meet CO2 targets.

But what is preventing an easy transition to WLTP?

What are the complexities when implementing WLTP?

Although CO targets are becoming increasingly significant to the economic performance of automotive manufacturers, there a number of complexities facing the implementation of WLTP.

Differing WLTP policies

Firstly, it is extremely difficult for OEMs to predict when a country is likely to go

live with their WLTP systems, resulting in huge investment in scenario planning and approximations. This was demonstrated by France, who went live with their WLTP scheme on March 1, 2020, despite still being in discussion the evening prior.

Even once WLTP systems are live, that doesn’t mean they are set in stone. In September 2018, Finland was the first country to roll out their WLTP taxation policy, but it has been far from a smooth process. In fact, an unexpected decline in sales following the change in taxation, prompted Finland to make a range

of amendments to their policy in January 2019, and once again in January 2020. Even the smallest changes in WLTP policies can have significant impact on a market’s bottom line. And, with each country independently controlling legislation, automotive players need to be reactive to sudden shifts in policy.

Alongside this, as OEMs and local markets across Europe also have different policies and WLTP solutions in place, calculations are only likely to become increasingly complex as it is adopted more widely.

The cross data burden

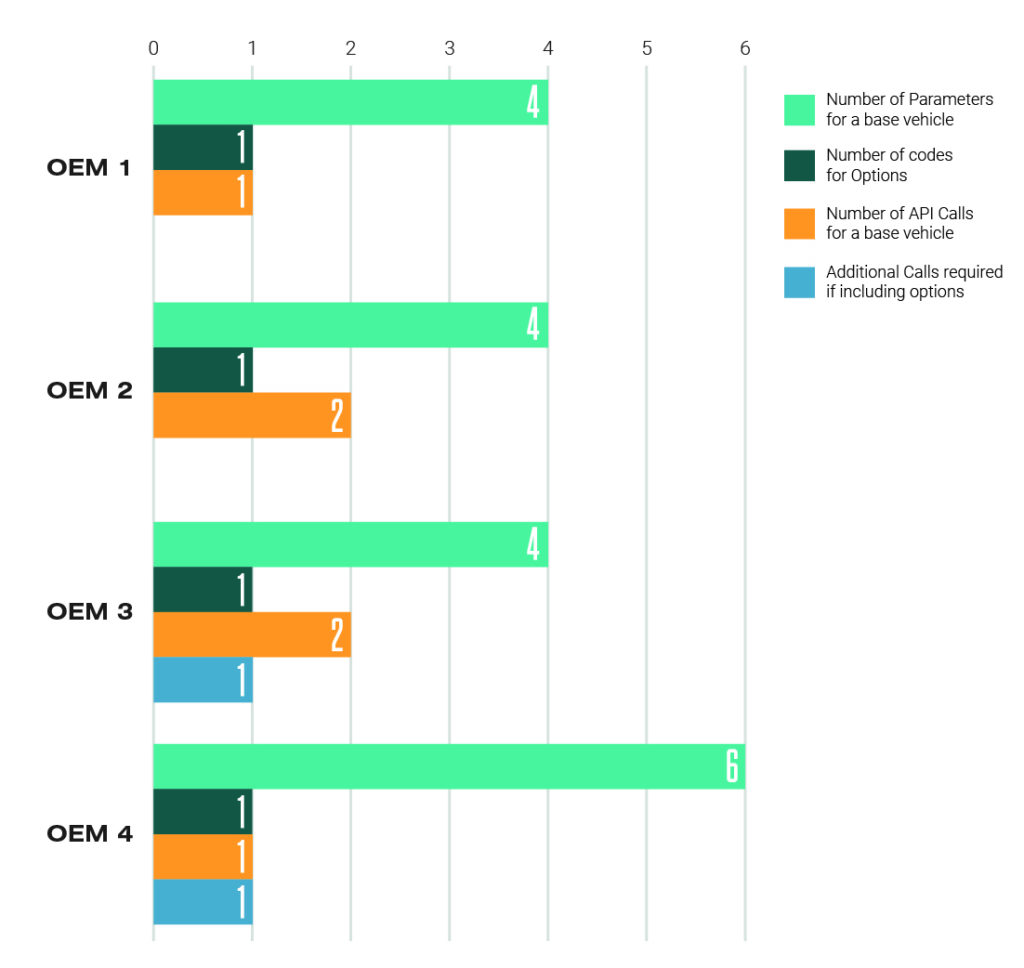

When each policy is constructed and laid out, there is a huge volume of work required to guarantee correct WLTP calculations. On average, there are 15 – 20 steps required before a manufacturer can release reliable WLTP data, and each step has to be correct in order for the API to work efficiently. Therefore, there is a need for 100% accuracy, 100% of the time, a labour intensive and often complex process.

There is also a minimum level of data OEMs must supply in order to ensure reliable WLTP measurements.

Legislation is not the only force driving the implementation of WLTP services. Companies purchasing vehicles from OEMs, are setting increasingly ambitious carbon footprint targets within their annual statements – in line with their CSR policies. If an OEM is unable to match the target previously established, these buyers will often look elsewhere. If an OEM is to compete for the rights to supply to the biggest companies around the world, they need to ensure their WLTP figures are consistently accurate.

In an already competitive industry, the green agenda and WLTP are only increasing pressure among OEMs. If they cannot precisely calculate WLTP figures, they will likely fall behind their peers.

Consumer preferences

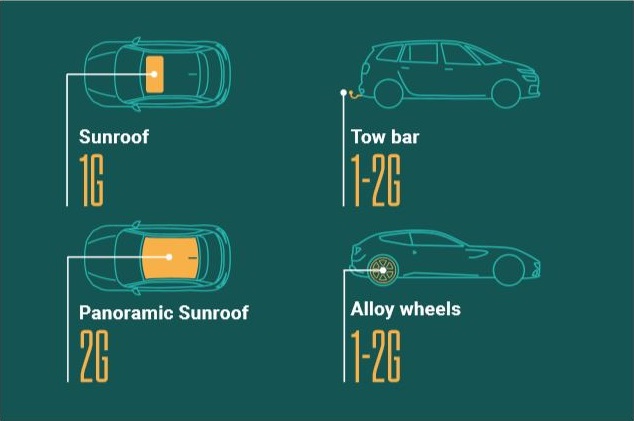

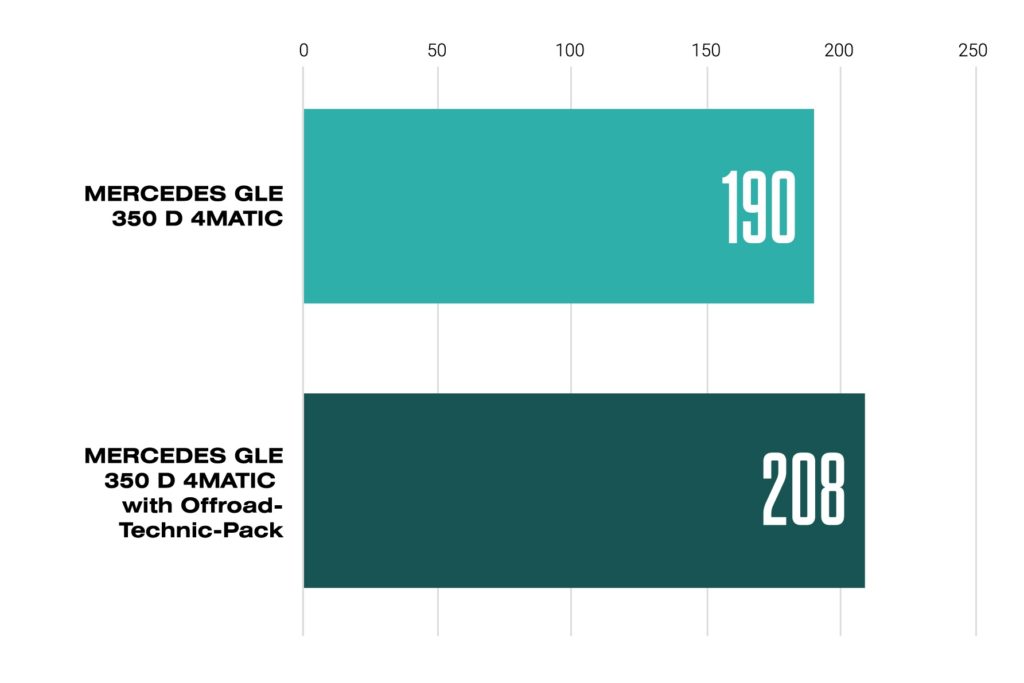

Difficulty also arises on the consumer level. Once WLTP taxation is enforced, each add-on and design option available will need to be taken into account. Even if a customer applies a minimal add-on so that doesn’t impact the overall marketing specification of the vehicle, it will likely have a significant effect on its WLTP rating. For instance, if OEMs change the type of battery used in a vehicle, this will impact the rating and consumers need to be mindful of the effect caused by each one of these changes.

External factors

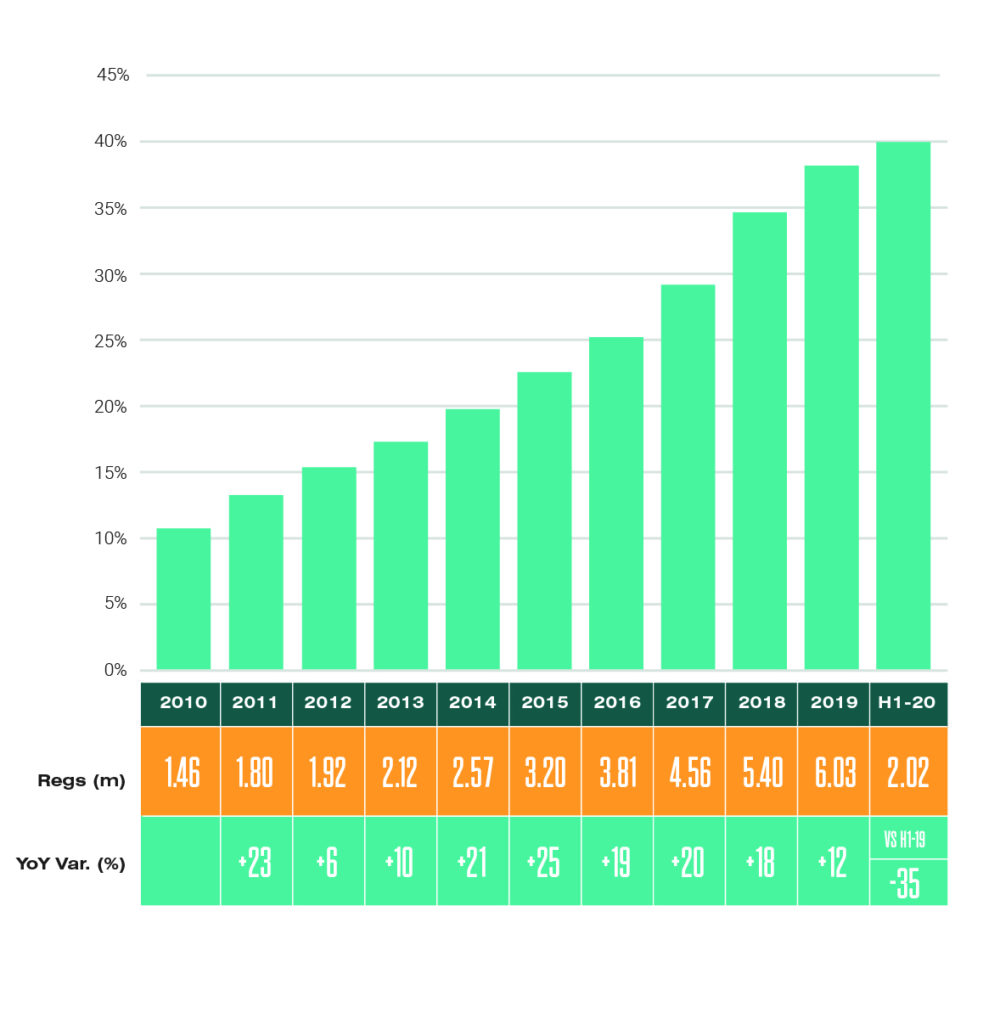

There are also a number of external factors that impact the continued drive for WLTP solutions. These factors are often unforeseen, such as the recent spread of the COVID-19 pandemic. No one could have predicted the emergence of the pandemic and the fundamental impact it has had on all aspects of day-to-day life. It is still too soon to know what long-term impacts COVID-19 might have on consumer behaviours,

motivations, buying habits, and ultimately how WLTP will fit into this, but undoubtedly it will have an effect. 2020 has been dominated by COVID-19 – it has provided a timely reminder that external factors can change the industry landscape in an instant.

What are we seeing and might continue to see following the adoption of WLTP?

It is likely that as WLTP is adopted across Europe, the automotive industry will face a number of changes.

Product offering

In the first instance, this can be applied to adjustments in product offering. Providing customers with numerous options for add- ons and design amendments will become increasingly difficult, as each product contributes differently towards WLTP values.

Therefore, many OEMs, in the short-term at least, may act to reduce the options available or package them together so there are fewer variables to measure. This trend has already started within some OEMs.

As add-on features contribute to the overall CO2 levels emitted by vehicles, and thus cause higher levels of taxation, there could also be an inadvertent shift in consumer preferences, as they may move away from purchasing additional, environmentally damaging, features.

That is not to say OEMs should drop add-ons entirely. Rather, we predict there will be a transition in consumer preference towards environmentally friendly extras, such as low rolling resistance tyres, low draft alloy wheels or aero dynamic packs.

Environmental concerns

Climate change and broader environmental issues have been on the industry’s radar for many decades. However, it remains to be seen how the post-COVID-19 world will approach these challenges. We expect, tactics will not be uniform across the board.

The world has glimpsed a new way of living, less driving and cleaner air. More than ever, it is increasingly likely that the microscope will now focus on high-emitting industries, such as the automotive space.

However, there are clear obstacles for some markets, and our data shows that there is still huge demand for large, high-emitting, vehicles such as SUVs . Nonetheless, we believe the shockwaves, caused by the pandemic, may alter consumer preferences in a significant way particularly if governments, OEMs and automotive dealers start to deliver greater education surrounding incentives and the benefits of lower emission vehicles.

Centralisation

In order to measure WLTP values, OEMs feed into a central calculator from their local systems, which configure the data. This centralisation is prompting a number of benefits for consumers.

Previously, in order to remain competitive, the industry was often reluctant to divulge data and sensitive information to customers. However, as WLTP requires detailed information for its calculations, there have been large improvements in transparency and data sharing. As every player in the industry has had to adjust to this centralisation, large steps have been taken to ensure the sector stays on track with implementing WLTP solutions.

Digitisation

Similarly, digitisation has been boosted across the automotive industry. Where companies once saw little reward in publishing data, the global pandemic has meant that automotive businesses have had to adapt in fear of falling behind. With millions working from home, there has been a shift towards e-commerce with consumers looking to purchase vehicles from their own homes. In order to successfully navigate this change, automotive companies are having to embrace digitisation, and invest in their online sales and production techniques.

This move toward digitisation also allows greater access to vital information, including WLTP data. This encourages price comparisons and shifts the balance of power back to the consumer.

The digitisation, in part provoked by the pandemic and WLTP, also presents OEMs with new ways to drive efficiencies and make better deals. For a long time, many segments of the industry have been stuck in analogue. The need for OEMs to deal in big data has forced many away from aspects such as printed pricelists in dealers and move towards online price guides and open information – a significant step.

Conclusion

WLTP has been in the background for many years, undergoing scrutiny and testing.

Now, the automotive industry is finally seeing the regulation coming into force, policies being formalised, and countries across the continent are readying themselves for WLTP deadline day.

OEMs have spent vast sums of money on digitisation for WLTP and faced one of their biggest challenges yet – migrating to new technologies in order to develop models that are less reliant on fossil fuels.

While all companies have made significant efforts towards meeting the incoming CO2 targets, further action needs to be taken, and those who took the greatest strides in 2019, focused on a mixture of strategies, including lighter vehicles, fewer SUVs, and more EVs.

A mix of strategies is often beneficial for a number of reasons. For instance, although hybridisation is positively contributing to CO2 reduction, EVs alone will not be enough to reach the targets, as consumers continue to demand high emitting vehicles.

Therefore, the challenge that remains for OEMs is how to remain profitable, while attempting to meet CO2 targets and avoid taxation penalties. For this reason, many will welcome the arrival of WLTP, as it will push the automotive industry in their attempts to achieve their CO2 ambitions.

We also believe that consumers will witness an outstanding growth and availability of electric vehicles, alongside new add-ons and eco-friendly features. Fleets and other buyers outside of Europe, will begin to follow suit and take a greater steer on emissions.

Despite the fact that many industry players – such as leasers – are not responsible for CO2 goals, they will want to ensure their customers are presented with vehicles that meet company policy emissions requirements. Therefore, it is crucial that the complexities identified are addressed to maximise the positive impact of WLTP.