European demand for BEVs soars by 77% in February

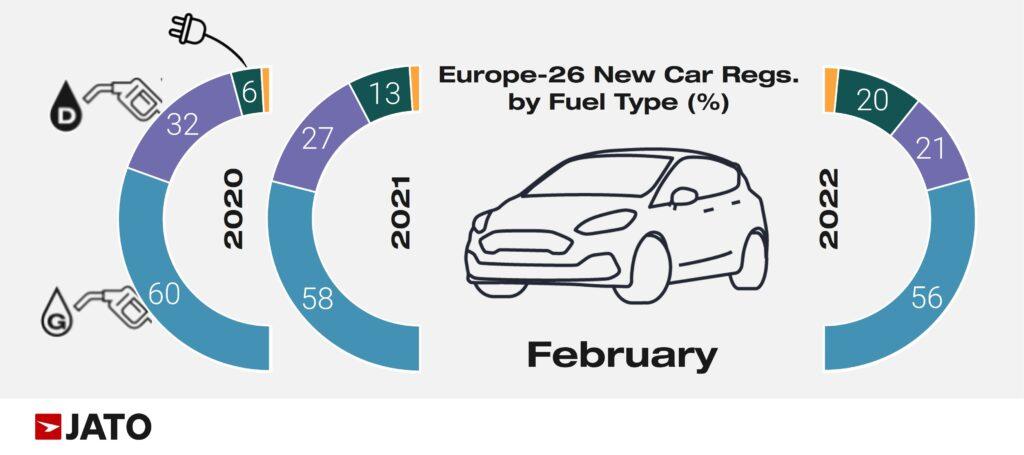

- BEV and PHEV registrations accounted for 20% of the total volume in February

- Tesla led the BEV market with 18.1%

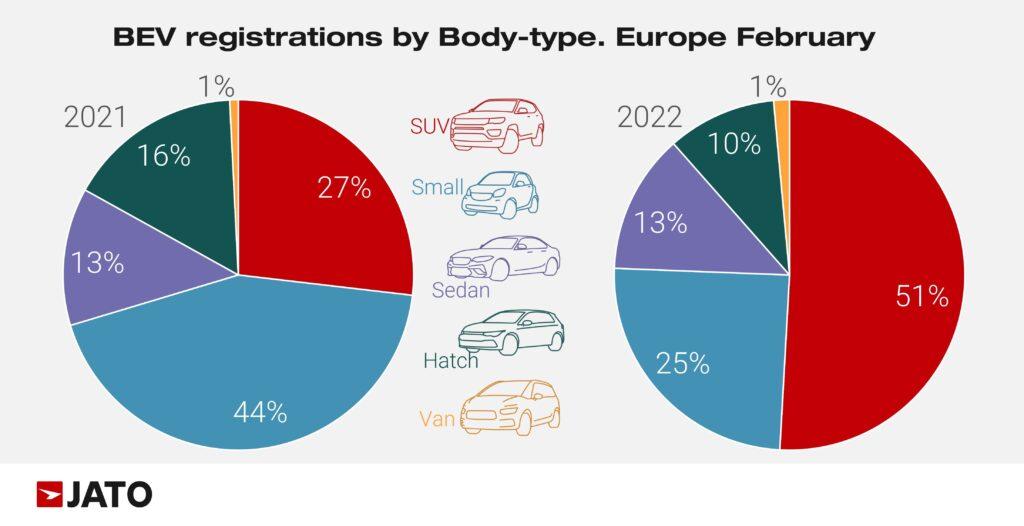

- SUVs accounted for 51% of all BEV registrations

The European new car market continued to struggle in February. The geopolitical situation in Ukraine impacted the semiconductor shortage further while also affecting other aspects of the supply chain. As a consequence, many OEMs were forced to halt production, delaying the delivery of new vehicles.

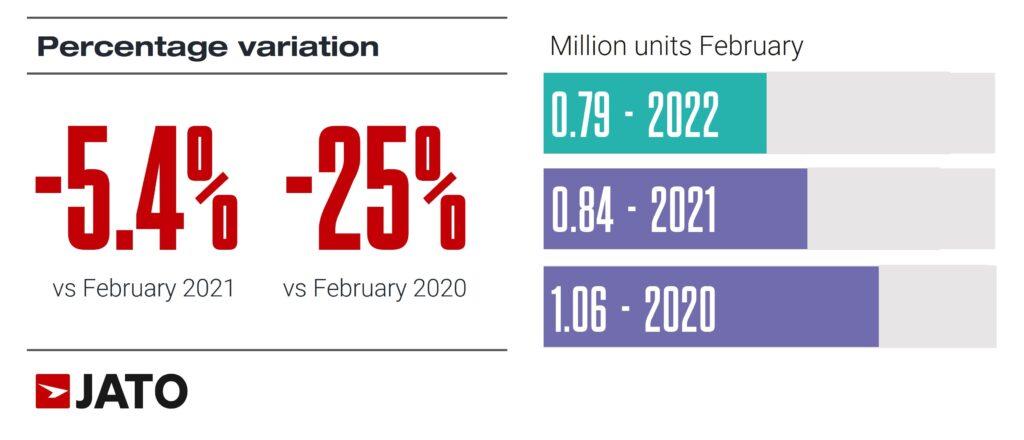

According to data from JATO Dynamics for 26 European markets, new vehicle registrations fell by 5.4% in the second month of the year to 794,576 units. The year-to-date volume decreased by 3.8% to 1,607,321 units. Felipe Munoz, Global Analyst at JATO Dynamics, commented: “Last month’s results marked the lowest volume recorded in February for four decades. The market has historically been defined by high volumes and low margins but we’re beginning to see this shift the other way around.”

BEVs drive demand for low emissions vehicles

In February, battery electric vehicles (BEV) represented 56% of all demand for low emissions vehicles (BEV, PHEV, Hydrogen). Volume increased by 77% compared with February 2021 to a total of 87,400 units. In contrast, the volume of plug-in hybrids (PHEV) increased by just 6% to 67,400 units.

The emergence of new models and the ongoing support of incentives has had a clear impact on consumer demand for BEVs. SUVs continued to be a key driver of growth accounting for 49% of total demand across all segments. Munoz continued: “Without the arrival of competitive electric SUVs, the BEV segment looked set to remain a niche market in Europe. But thanks to OEM investment in these vehicles, demand continues to grow which is helping to offset the challenges currently faced by the industry.”

SUVs accounted for 51% of all BEV registrations in February, however these vehicles accounted for only 11% of total SUV registrations, indicating that there remains significant potential for electrified SUVs to grow within the segment.

Tesla leads the BEV market

Tesla led the BEV market in February with 18.1% market share, ahead of Volkswagen Group which secured 17.6% across all brands. The Volkswagen brand was outsold by Hyundai and Kia which took second and third position respectively in the ranking by brand.

Tesla’s results are explained by the continued popularity of the Model 3, the top-selling BEV in February, in addition to the success of the Model Y which secured second position in the BEV ranking by model. The Model 3 was the most popular BEV in Spain, France and Germany, while the Model Y led in Austria, Belgium, Switzerland, Denmark and the UK. Munoz added: “Tesla’s February results suggest that we could well see new monthly records for the brand in March.”

Volkswagen’s Golf is back on top

In the general model ranking the Volkswagen Golf regained the top position with more than 15,000 units, down by 6% compared with February 2021. Within the top 10, only the Peugeot 3008 and Hyundai Tucson registered growth in February.

The Toyota Yaris Cross, Tesla Model 3, Mini Hatch, Opel/Vauxhall Mokka, Hyundai Kona, Kia Sportage, Tesla Model Y and Citroen C4 also posted strong results. Among the latest launches, the Renault Arkana was the third best-selling Renault; the Hyundai IONIQ 5 outsold the Volkswagen ID.4 and Skoda Enyaq. Volkswagen registered more than 3,000 units of the Taigo while Kia registered more than 2,000 units of the EV6.

Download file: JATO European Car Registrations February 2022.pdf

Leave a Reply