New Dataset – LCV Specifications: India

According to the International Monetary Fund (IMF), as of October 2015, the Indian economy is worth 2,182 trillion US dollars. It is the 7th-largest global economy at 8,027 trillion US dollars, the third-largest by purchasing power parity, or PPP. India is currently ranked in 5th position in commercial light vehicle production and sales and is expected to be the 3rd highest market globally by 2020.

In April 2016 JATO launched a new dataset – LCV Specifications India – making our renowned specifications data available for any business with an interest in the light commercial market in India.

In 2015, vehicle sales in India were 2.7 million units for passenger vehicles and 290,000 units for LCV. The LCV market is dominated by three brands – Mahindra, Tata Motors and Ashok Leyland, who had more than 90% market share between them in 2015.

(Source: SIAM Society of Indian Automobile Manufacturer)

Top Makes (LCV)

Top Makes (Car)

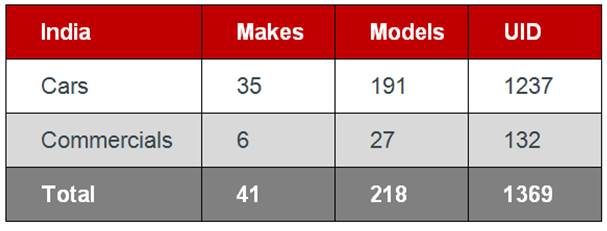

Latest Researched Data Statistics

The automotive industry in India is one of the largest in the world with an annual production of 23.37 million vehicles for the FY 2015, following a growth of 8.7% over the previous year. The automotive industry accounts for 7.1% of the country’s gross domestic product (GDP). In order to keep up with the growing demand, several auto makers have started investing heavily in various segments of the industry during the past few months. The industry has attracted Foreign Direct Investment (FDI) worth 13.48 billion US dollars during the period April 2000 to June 2015, according to data released by the Department of Industrial Policy and Promotion (DIPP).

The Government of India encourages foreign investment in the automotive sector and allows 100% FDI under the automatic route. The Government of India aims to make automotive manufacturing the main driver of the “Make in India” initiative, as it expects the passenger vehicles market to triple by 2026 to 9.4 million units as highlighted in the Auto Mission Plan (AMP) 2016-26.

Recently, the Indian market has seen some volatility around changes to duties, tax changes and tightening of rules around safety equipment fitted to vehicles. These changes are all intended to strengthen the market going forward, but have resulted in some short term fragmentation of the vehicles able to be sold. However, our data provides a fascinating insight into the Indian automotive industry which would prove highly valuable to any customer.

If you have any questions regarding this article, or require any further insight into the Indian automotive market, please do not hesitate to get in contact with us via JATO.com or email enquiries@jato.com.