Brazil boosts the Latin American car market, which grows by 4.9% through September

- Growth slows down in Q3 due to the drop posted by Argentina

- As in the USA, the SUV and pickups gain traction, while subcompact cars continue to lead the ranking by segments

- Renault-Nissan is the biggest car maker by sales volume, and FCA is the biggest market share winner during the period

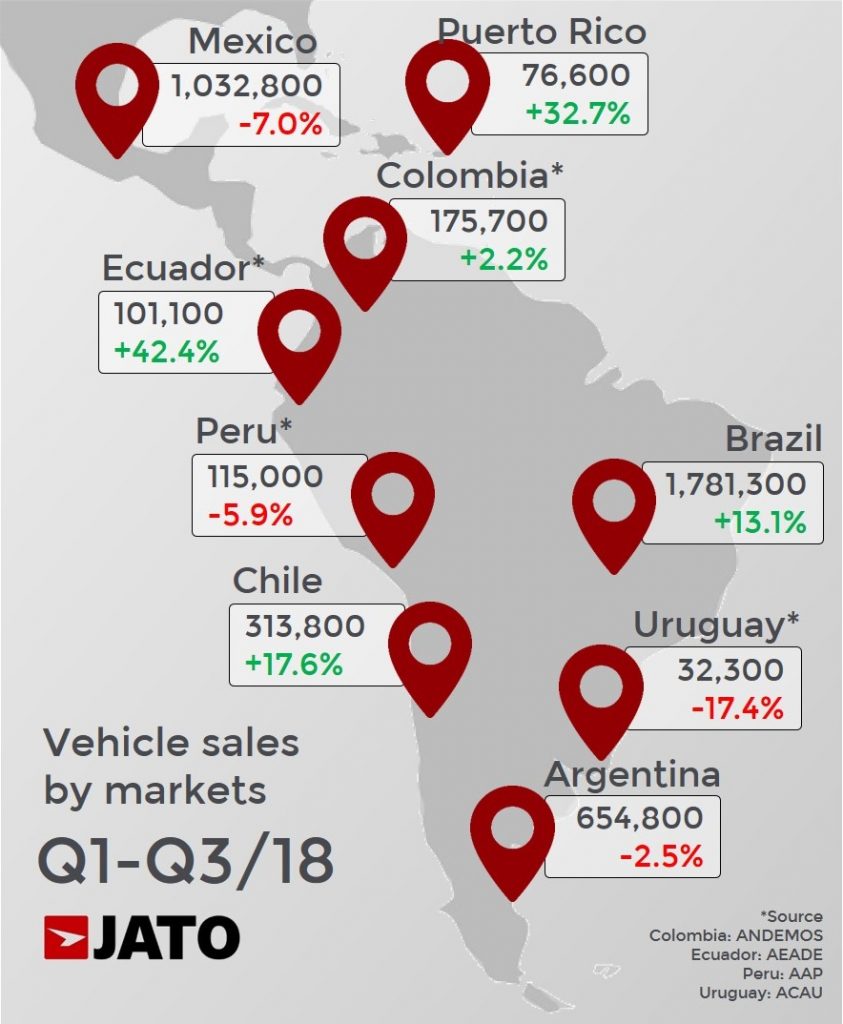

The positive trend seen in the Latin American car market was confirmed throughout September. Passenger car and light commercial vehicle sales in nine key markets increased by 4.9%, during the first nine months of the year, to 4.28 million units. This total makes the region the fourth largest vehicle market in the world, behind China, USA and the European Union, and ahead of Japan.

“The slow recovery of the Brazilian car market provides an explanation for the increase posted throughout September. However, it is not clear how long this market will drive the growth, especially when Argentina and Mexico record red numbers”, comments Felipe Munoz, JATO’s global analyst. Despite the good results, the growth rate was smaller than the increase posted during the first half. Munoz adds: “the sales grew by 7% throughout June, but the worsening conditions of the economy in Argentina, and the credit situation in Mexico, have started to have a negative impact on the region.”

The situation in Brazil is made up of two different scenarios. On one hand, the economic recovery continues and more consumers are willing to buy a new car, even if the 1.78 million units sold so far is significantly less than the 2.67 million vehicles sold during the same period of time in 2012. On the other hand, car production is already seeing a drop on exports following the worrying Argentinian economic crisis. September figures showed a big drop of 35% in exports from Brazil to Argentina.

Mexico, the second largest market by volume, and the top car exporter in the region, leaves behind the political and economic uncertainty from the presidential elections and the new trade agreement with the USA. However, as Gerardo San Roman, president of JATO Dynamics Latin America, says “the decrease of sales is closely related to the long term credits of up to five years, granted by the car makers. Therefore the consumers are now taking their time to reduce their debts”. All markets have their peak, and Mexico is not an exception”.

But Brazil was not the only growing market. The good economic situation in Chile, along with lower car prices and rise in consumer confidence, explains the strong increase posted by the car market. In fact, sales are growing so fast that in September the total in Chile (39,200 units) was not far from the volume seen in Argentina (46,100 units).

The situation in Colombia has improved thanks to the clearer political landscape, though a stronger dollar is likely to hit the increase. Ecuador continues to shine and is catching up with Peru thanks to the increasing offer following the free trade agreements signed by the country.

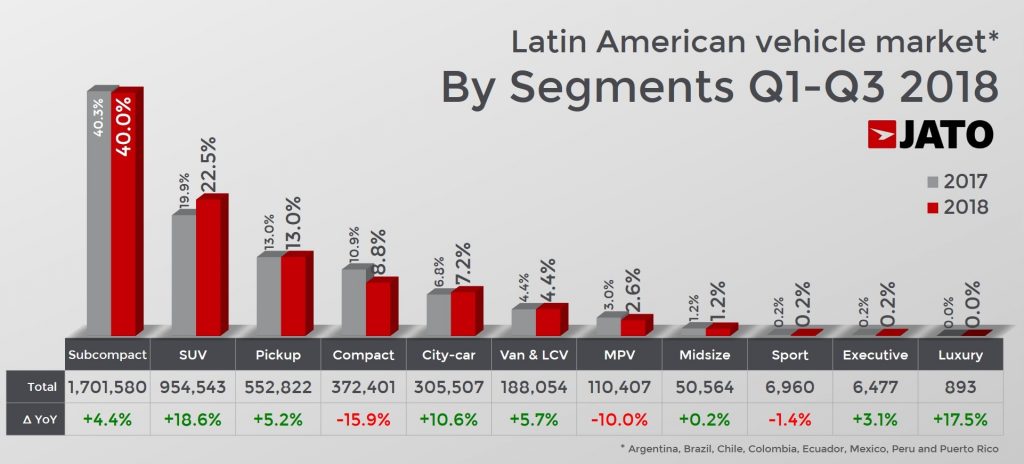

The subcompact cars (B-Segment) continue to dominate the roads of the region. Throughout September, there have been more than 1.7 million units sold, counting for 40% of the total market. This segment is led by General Motors with 355,000 units sold, which is 2.9% less than during January-September 2017. It was followed by Volkswagen Group with 321,000 vehicles, outselling Renault-Nissan alliance, which recorded a 9.2% decline following a lower demand of the Renault Sandero.

The subcompact cars (B-Segment) continue to dominate the roads of the region. Throughout September, there have been more than 1.7 million units sold, counting for 40% of the total market. This segment is led by General Motors with 355,000 units sold, which is 2.9% less than during January-September 2017. It was followed by Volkswagen Group with 321,000 vehicles, outselling Renault-Nissan alliance, which recorded a 9.2% decline following a lower demand of the Renault Sandero.

Although the subcompacts count for the majority of the vehicle market in Latin America, the main increase in growth came from the SUVs. While the demand for subcompacts grew by 4.4% between January and September, SUVs posted a 18.6% increase. Brazil and Chile drove the growth, but Puerto Rico and Ecuador also saw sales advance by 48.5% and 44.3% respectively. Half of the SUVs sold in the region were B-SUVs.

Most of the SUVs sold in Latin America have the badges of Renault-Nissan, whose market share was 20%. The Nissan Kicks continue to lead the ranking with 65,600 units, up by 45.5% when compared to the same period of last year. Renault-Nissan is followed by Hyundai-Kia Group, with 13% of the share, and FCA, which outsold Honda thanks to the popular Jeep Compass and Renegade, the third and fifth best-selling SUVs in the region.

Most of the SUVs sold in Latin America have the badges of Renault-Nissan, whose market share was 20%. The Nissan Kicks continue to lead the ranking with 65,600 units, up by 45.5% when compared to the same period of last year. Renault-Nissan is followed by Hyundai-Kia Group, with 13% of the share, and FCA, which outsold Honda thanks to the popular Jeep Compass and Renegade, the third and fifth best-selling SUVs in the region.

The Chevrolet Onix is still the top-selling car in Latin America with almost 178,000 units, up by 7.9%. This subcompact hatchback topped the rankings in Brazil and was the fourth best-seller in Argentina, and counted for 27% of total sales of General Motors in the region. The second position was again occupied by the Ford Ka (known as Ka+ in Europe), while the third position was taken by the Nissan Versa, replacing the Volkswagen Gol.

Among the big winners there are the Chevrolet Spark/Beat, Fiat Argo, Renault Kwid and the Volkswagen Polo. Outside the top 25 it is important to mention the +62% posted by the Renault Captur, +30% by the Hyundai Accent, +20% by the Toyota Rav4, +46% by the Suzuki Swift and a 116% increase posted by the Volkswagen Tiguan Allspace. The latest launches include the 34,500 units of the Volkswagen Virtus and the 31,200 units of its rival, the Fiat Cronos; the Toyota Yaris hatchback, which recently launched in Brazil and sold 15,300 units; and the Chevrolet Cavalier’s volume, which totalled 12,200 units.

Among the big winners there are the Chevrolet Spark/Beat, Fiat Argo, Renault Kwid and the Volkswagen Polo. Outside the top 25 it is important to mention the +62% posted by the Renault Captur, +30% by the Hyundai Accent, +20% by the Toyota Rav4, +46% by the Suzuki Swift and a 116% increase posted by the Volkswagen Tiguan Allspace. The latest launches include the 34,500 units of the Volkswagen Virtus and the 31,200 units of its rival, the Fiat Cronos; the Toyota Yaris hatchback, which recently launched in Brazil and sold 15,300 units; and the Chevrolet Cavalier’s volume, which totalled 12,200 units.

Chinese brands also gained traction as their sales increased by 35% to 102,200. Their market share jumped from almost 2.0% in January-September 2017 to 2.4% this year. They have more visibility in Chile, Peru and Ecuador, where their market share oscilated between 12% and 15%.

Many thanks to Oliverio Garcia from ANDEMOS Colombia, Alfredo de las Casas from AAP and Oscar Calahorrano from AEADE.

Click here for the Spanish version: Q1-Q3 2018 Latinoamerica Comunicado de prensa – Final

Click here for the Portuguese version: Q1-Q3 2018 América Latina Comunicado de imprensa – Final

More Articles

- European registrations surge by 21% in December with Tesla Model 3 the third best-selling car

- JATO Whitepaper – ’Fiction to Reality – The Evolution of Electric Vehicles’

- European car registrations in July fell for the first time in 34 months

- European new-car sales growth slowed in October, as big markets posted smaller increases

- Small SUVs continue to gain traction as European registrations remain stable in May 2018