European new-car sales growth slowed in October, as big markets posted smaller increases

- Volume increased by less than 2% in Germany, France and Spain. Italian sales bucked the overall market trend with higher growth

- The slowing growth stemmed also from weakness in the UK market

- October YTD sales gain reduced to 8.3%

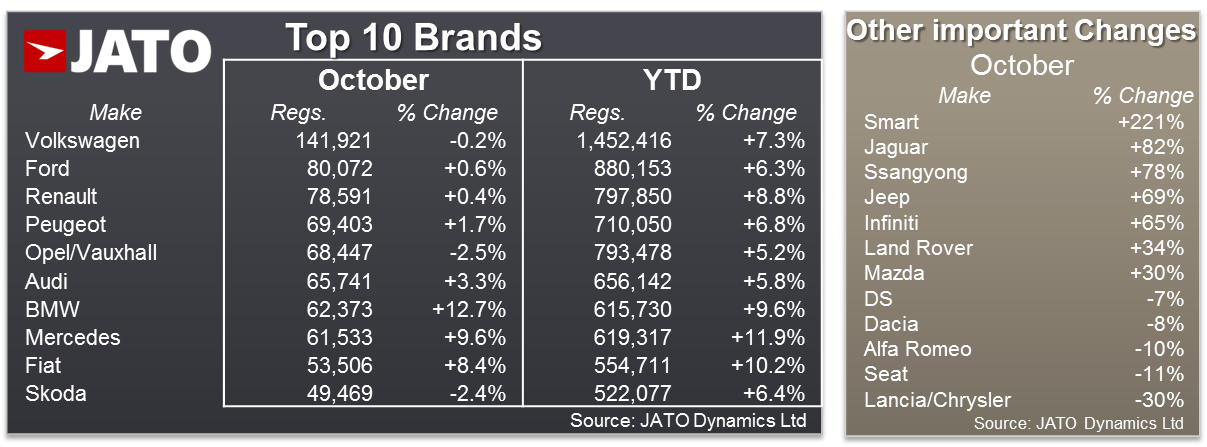

- Although Volkswagen’s sales stalled, it retained its position at top of the leaderboard. BMW was the only brand to post double-digit growth

European new-car sales increased by 2.4% from October 2014 to 2015 to 1.14 million cars, a smaller increase than reported in September 2015 by JATO Dynamics. It was also the second lowest monthly volumes increase seen so far this year. YTD figures indicate that sales totalled 11.92 million units, up by 8.3%, the smallest increase since May 2015. The annualised sales rate1 totalled 13.91 million units, up by 0.19% on September’s result.

1 Indicates total sales of the last 12 months

The results by market show that the slow down affected the majority of the Big EU 5 with the UK posting its first sales decline in more than three and a half years. It was the second largest market with 178,000 units, down by 1.1%. Although Germany topped the country ranking with more than 278,000 cars sold, it posted its smallest increase of the year at +1.1%. Even though its annualised sales rate of 3,166,000 units reached the highest point since January 2015, it came in just above September’s 3,163,000 pace. The results for France followed the same trend seen in Germany with sales up by only 1%. The big change came from Spain, where total growth slowed from the double-digit growth rates seen in recent months to just +1.9%, the lowest gain so far this year. Meanwhile, in Italy sales climbed by 8.4%, the largest increase among Big EU 5 markets. In total, the Big EU 5 markets sales increased 1.8% compared to October 2014.

Other important gains in October 2015 versus October 2014 included Sweden and the Czech Republic, with both markets reporting sales increases of more than 10%. Belgium and the Netherlands also outperformed the total market’s growth. Moving in the opposite direction were Austria and Switzerland, where sales dropped by 6.7% and 5.4%, respectively. “This month is the first time we saw the impact of recent challenges, with a slowing in volume growth across many markets and brands in the industry.” said Brian Walters, Vice President of Data at JATO Dynamics.

The brand ranking shows Volkswagen ahead of its rivals, but its sales remained flat at 142,000 units and 12.4% market share. The outstanding sales performance of the Passat was totally overshadowed by the reduction in sales of the Golf, Polo and Up. However, the German brand was not the only one to feel the effects of the slowdown; Opel/Vauxhall sales fell by 2.5% and those of Skoda by 2.4%. Meanwhile Ford, Renault and Peugeot posted slight increases. The only significant drivers of growth were BMW, Mercedes, Fiat and Audi – although Audi’s growth slowed considerably when compared to previous months. Further down the rankings, Mazda, Land Rover, Smart and Jeep posted significant increases.

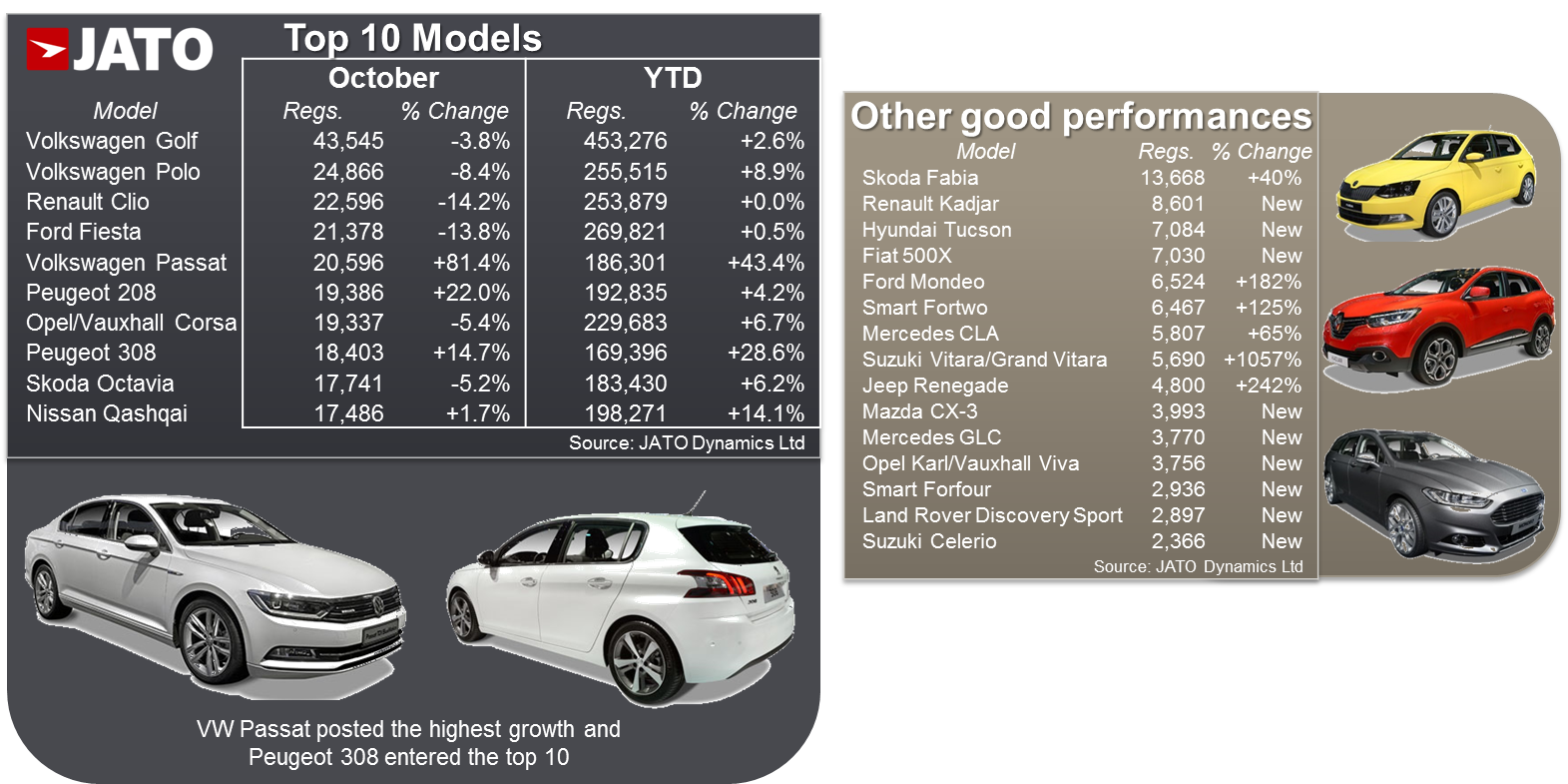

The general slowdown is more evident when looking at sales by models. October’s rankings show that only four models in the top ten posted a sales increase, with three of them reporting a double-digit growth. The Volkswagen Golf remained in pole position with sales down by 3.8%, the smallest decline on the leaderboard. Its drop was followed by the bigger losses reported for the Volkswagen Polo, Renault Clio and Ford Fiesta. The new Volkswagen Passat occupied fifth position, with volumes rising by a massive 81%. Peugeot was able to position two models in the top ten thanks to the positive performance of its 208 subcompact and 308 compact. Outside the top ten, the Fiat Panda (which outsold the 500), and Skoda Fabia had very strong results. October was also a good month for sales of the Renault Kadjar, Fiat 500X, Hyundai Tucson and Suzuki Vitara.

“The market saw a slowdown that affected the sales performance of some important models. The topsellers showed signs of a downturn that can be attributed to a number of factors. It remains to be seen whether this is the beginning of downward trend or a short-term result of recent challenges” concluded Walters.

More Articles

- New car CO2 emissions hit the highest average in Europe since 2014

- European car market posts strongest Q1 performance since 2000, despite monthly decline in March

- US Vehicle Sales fell by 1.9% in the first quarter of 2017 following declines in traditional segments

- Automotive Industry Shows Resilience as Europe sees Highest Year-to-Date Car Registrations since 2007

- Peugeot leads the Volume Brands in Europe as average new car CO2 Emissions continue to fall