- Total market registrations decrease in November

- SUV market share holds above 40%, but growth stagnates

- The Volkswagen Golf leads the way, just shy of 25,000 units

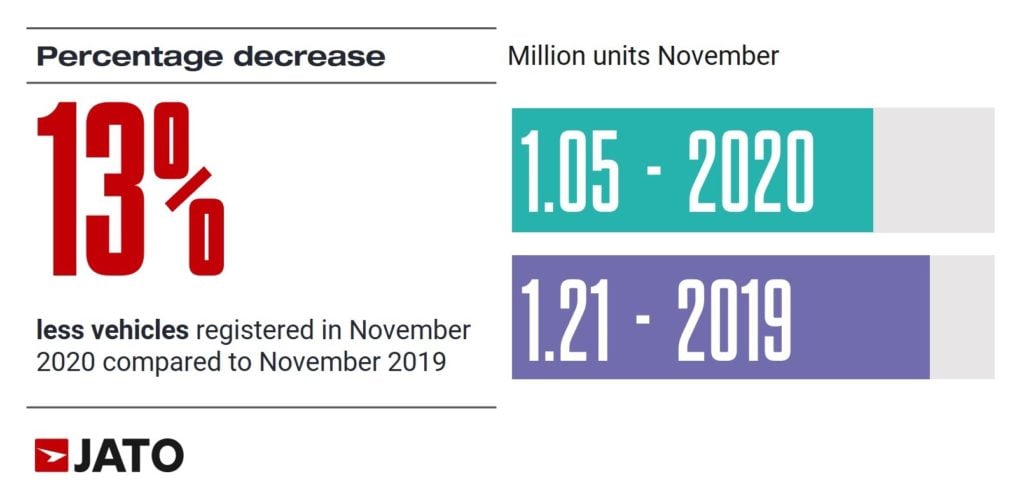

Once again, November has seen a double-digit year on year drop in European new car registrations, as part of the ongoing impact of the coronavirus pandemic. In November, the market registered 1,045,129 new cars – 13% less than for the same period in 2019. Consequently, November 2020 has recorded the lowest volume since 2014, when just 989,500 units were registered.

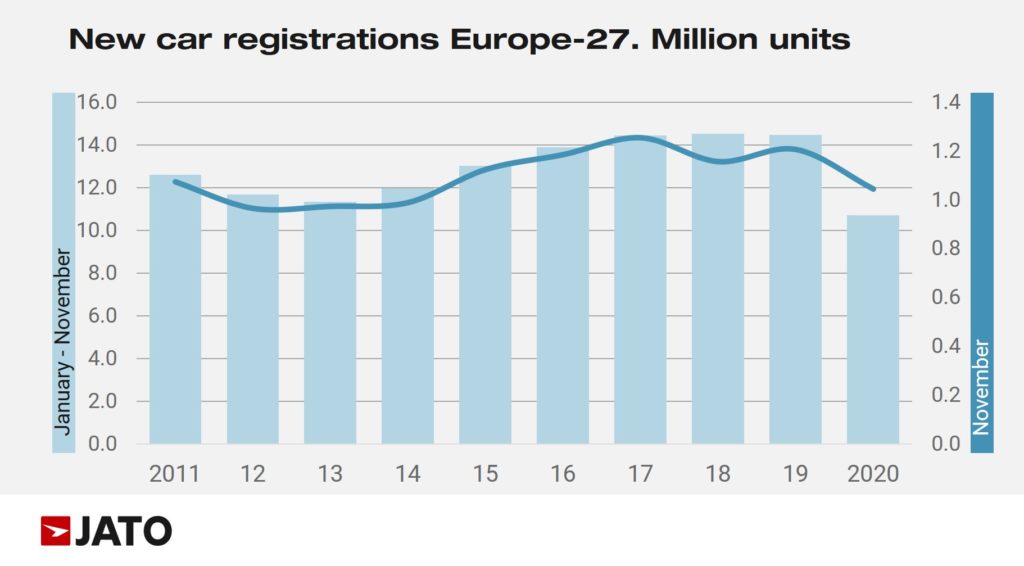

Year-to-date figures continue to point to a concerning trend, with YTD volume dropping by 26%. European consumers registered 10.71 million units between January and November – the lowest YTD figures so far this century. Felipe Munoz, global analyst at JATO Dynamics, commented: “The global pandemic and its impact on mobility has been extremely painful for the automotive industry, indeed more painful than any other economic crisis that has hit Europe over the last two decades.”

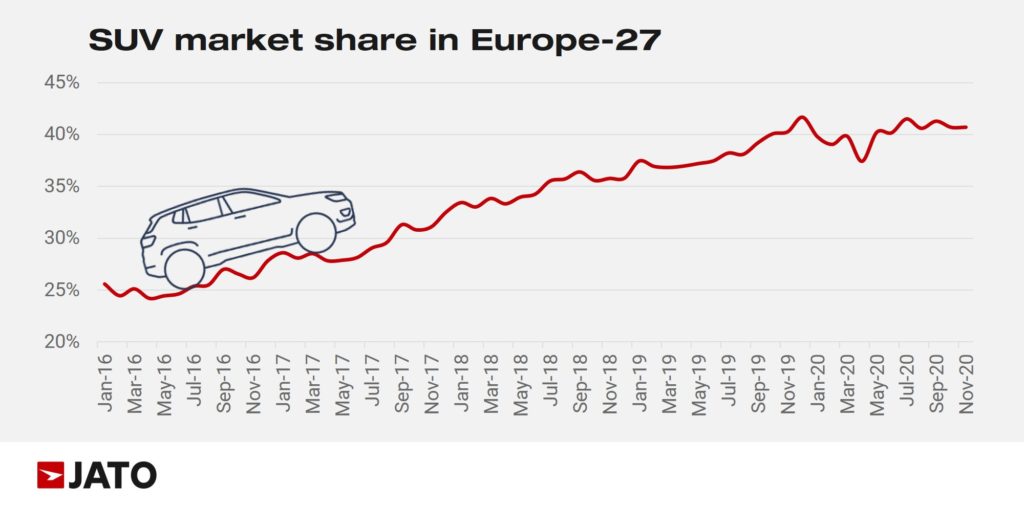

Over the last six years, SUVs have been a consistent driver of growth for Europe. As the market started to recover between 2011 and 2013 following the economic downturn, increasing buying power and demand shifted from hatchbacks, wagons and MPVs, to SUVs.

And, in 2019 – before the tangible impact of COVID-19 had taken hold – SUVs registered a total of 6.03 million units in Europe. They accounted for 38.3% of the total market – a record for the industry. This year, however, the state of play has changed dramatically. OEMs are no longer experiencing rapid growth, with the whole industry searching for positive signs going into 2021.

For the majority of the year the market share of SUVs remained stable, between 40% to 41%. However, their registrations fell by 13% in November, and 21% YTD when compared to 2019. Regardless of this, between January and November, the market share of SUVs jumped from 38% in 2019 to 40.4% this year. Munoz continued: “The market has benefitted hugely from a wider SUV offering provided this year. But with the impact of Covid-19 still in full force, demand is no longer growing in parallel to new product launches, nor at such a fast pace”.

Conversely, B and C cars experienced declines below the overall average, in fact, their market share increased in November due to new arrivals and a more competitive electrified offering.

Volkswagen Golf keeps the lead

The overall ranking by models in November confirms that the Volkswagen Golf kept its position as the most popular car in Europe. The hatchback registered 24,800 units in November – just short of 255,000 units since January.

Only two SUVs made it into the top 10 – the Peugeot 2008, followed by the Renault Captur. Further down the ranking, Ford Puma, Volvo XC40, Audi A3, Renault Zoe, Volkswagen ID.3, Kia Niro, Mercedes GLA, Skoda Kamiq, Jeep Compass, Mercedes GLB, Nissan Juke, Audi Q3 Sportback, Kia Xceed, Suzuki Ignis, and BMW 2-Series, all posted healthy results.