- The Ford Fiesta was only 5,000 units behind the Volkswagen Golf

- Italy’s market grew by a significant 17.4% as a result of the country’s super amortisation policy

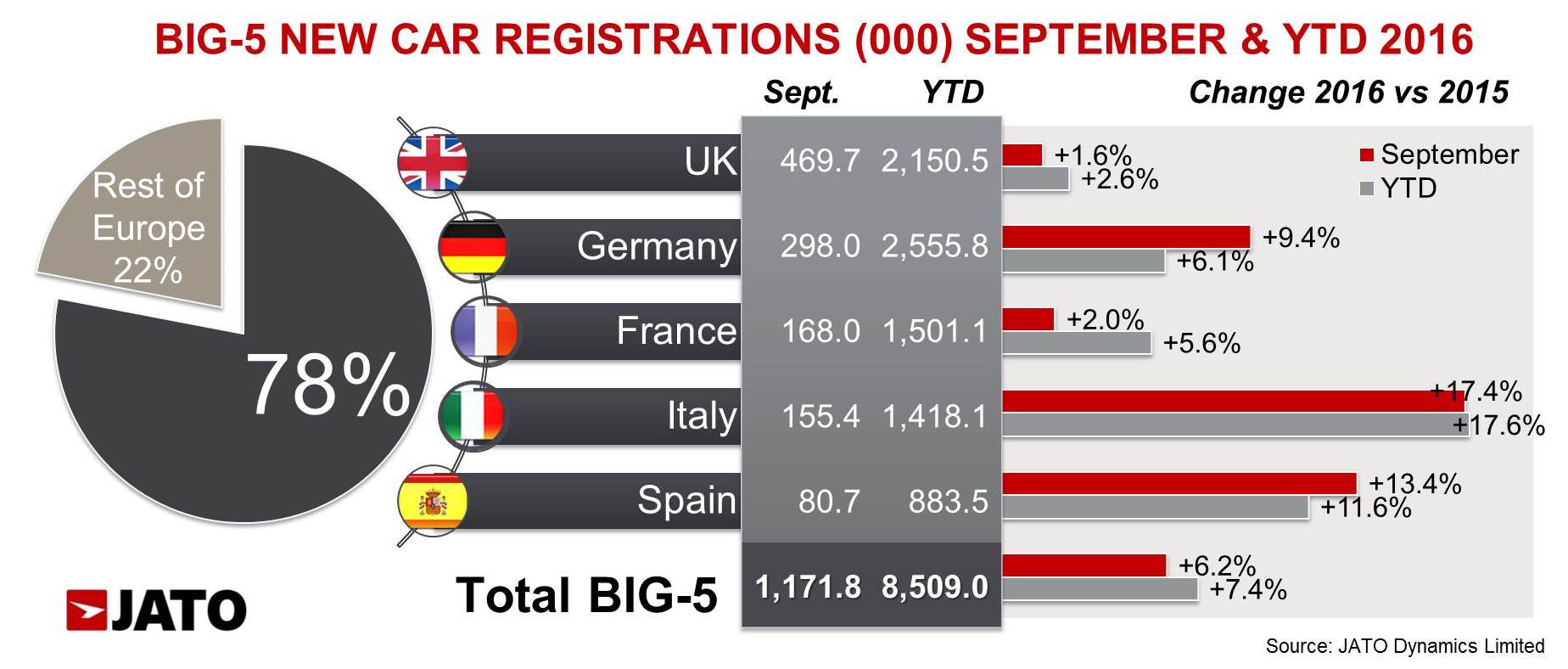

- Year-to-date registrations were up 7.4%, with 8.51 million units registered overall so far this year

Registrations in Europe’s ‘Big 5’ markets performed well in September, with 1,171,795 units registered, which is a 6.2% rise on the same month last year. For the year to date, registrations totalled 8.51 million units, an increase of 7.4%, SAAR figures came in at 11.61 million units, the highest figure recorded so far in 2016.

The European automotive industry was is in a positive mood after the five biggest economies, all recorded positive growth in September. Italy and Spain continued to lead the way, registering increases of 17.4% and 13.4%, respectively, when compared with the same period last year. Italy’s dramatic increase was the country’s best performance since September 2010, this can largely be attributed to tax incentives which have been enacted to encourage companies to increase investment in automotive fleets through the policy of super amortisation. Similarly, it was the fleet and rent-a-car markets which boosted Spanish figures and enabled Spain to register more than 80,000 units for the first time since September 2007. In contrast, France’s modest 2% increase on last year was due to increased sales of demo models which were up by a significant 20.5%, with private registrations falling by 4.6%. The UK and Germany complete the top five, posting increases of 1.6% and 9.4%, respectively, on the same period last year.

Volkswagen Group led the market, maintaining its position as Europe’s largest car manufacturer by registering 256,000 units in September, a 3.3% increase on the same period last year. However, the car maker lost 0.61 points of market share, going from 22.5% in September 2015 to 21.9% in September 2016. The car maker’s volume was boosted by the performance of the Skoda and Audi brands which posted increases of 8.4% and 7.9% respectively when compared to the same period last year. The Volkswagen brand’s performance stalled, registering 122,900 units which is a small 0.4% increase on the same month last year. Compact (C-Segment) cars accounted for 29% of the group’s total registrations, but volume for this segment fell by 5.3%. Their SUVs accounted for 17.5% of the group’s total, but its volume increased by a significant 20.9%.

Despite Volkswagen Group’s fall in market share, it was PSA that experienced the highest market share decline in September, falling from 10.1% to 9.0%. This was driven by double digit declines in registrations in the city car and mid-size car segments and a modest 2.6% rise in the SUV segment. Daimler achieved the biggest market share gain at 0.73 points, going from 6.4% in September 2015 to 7.2% in the same month this year. This significant growth was largely due to the strong performance of its core segments – Compact, Midsize, and SUVs. Jaguar Land Rover also performed well, its registrations were boosted by the growth the SUV segment, with 82% of its registrations being from this segment, a dramatic growth of 79%. The manufacturer’s performance was also boosted by the strong results of Land Rover and Jaguar which posted increases of fall in private registrations in the French market. Even with these challenges, the European registrations are on course for growth as we head towards the end of 2016.”

The performance of BMW Group is notable due to the 19.4% increase in registrations posted by Mini and the 52% increase in SUV registrations from the BMW brand. FCA registered 80,100 new vehicles, which is a 14.8% increase in registrations, as a result of the double-digit growth of all of its brands.

Felipe Munoz, JATO’s global industry analyst, commented: “The automotive industry is continuing to perform well despite the challenges in the UK market and the significant fall in private registrations in the French market. Even with these challenges, the European registrations are on course for growth as we head towards the end of 2016.”

The continued success of SUVs boosted the automotive market in September, with the segment representing 27.1% of market share. This can largely be attributed to strong demand for Compact SUVs (C-SUVs) and Midsize SUVs which grew by 34.4% and 49.5% respectively. The dramatic growth in the market share of the SUV segment was at the expense of the more traditional vehicles, with the City Car and MPV segments both suffering declines of 5.8% and 3.6% respectively. Similarly, other traditional segments posted only modest growth with the Compact segment (C-segment) posting a 2.4% increase on the same period last year and the Subcompact segment (B-segment) growing by only 0.1% compared to last year.

Although the Volkswagen Golf again topped the model table, it faced stiff competition, with the Ford Fiesta only 5,559 units behind. The distance between the Golf and the rest of the model ranking has not been this close since March 2015. Despite topping the ranking, the Golf posted a 15% decline on September 2015, whilst the Ford Fiesta recorded a less dramatic 8% decline which allowed it to close the gap. The Nissan Qashqai recovered following a decline in August to become the best selling SUV, outselling both the Renault Captur and the Volkswagen Tiguan in all of the five markets analysed.

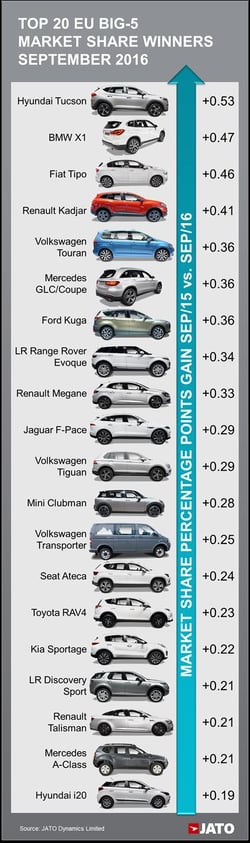

The big winners of the month in terms of market share were the Hyundai Tucson, which was also the seventh best selling SUV, the BMW X1, the Fiat Tipo, the Renault Kadjar and the Volkswagen Touran. Other notable changes in September include the Fiat 500 which entered the top ten model ranking, and the Opel/Vauxhall Astra which posted the highest percentage increase of the top ten ranking. Of the newest launches, the best performers were the Jaguar F-Pace, Mini Clubman and Seat Ateca.

“The close race at the top of the model ranking is hugely significant as it shows that the Volkswagen Golf is being challenged despite it hanging on to the top spot. Despite its historic dominance, the market leader will face significant challenges towards the end of the year as its rivals close in.”