- European new passenger car market records moderate growth in October

- Battery electric vehicles and plug-in hybrids main drivers of growth

- BYD posts strongest year-to-date market share gain

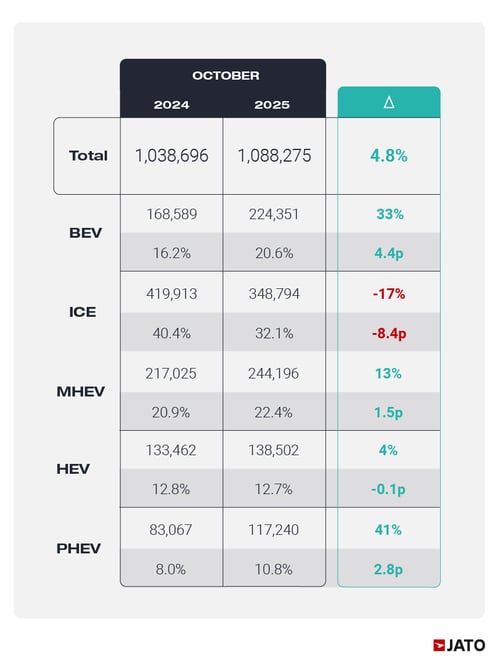

Europe’s new passenger car market experienced moderate growth in October. According to JATO Dynamics’ data, a total of 1,088,275 units were registered across Europe-28* in October 2025, up by 4.8% year-on-year. The key drivers of growth in terms of volume were Germany (+18.141 units, +7,8%), Spain (+13.260 units, +15,4%) and Poland (+4.645 units, +9,7%).

An uptick in registrations of battery electric vehicles (BEVs) was one of the factors behind the growth in the market, with registrations in October 2025 reaching 224,351 units, up 33% year-on-year. This drove the powertrain’s share of the overall market to 20.6%, up 4.4 percentage points year-on-year. Plug-in hybrid electric vehicles (PHEVs) were another driver of growth, with registrations increasing to 117,240 units, a 41% year-on-year increase. This brought the powertrain’s market share to 10.8% - a 2.8 percentage-point increase compared to October 2024 mostly driven by newcomers like the BYD Seal U PHEV (+5.476 units) and Jaecoo 7 PHEV (+3.804 units).

The increase in registrations of electric and hybrid vehicles was partially offset by a decline in registrations of internal combustion engine (ICE) vehicles, with 348,794 units posted in October – a year-on-year decline of 17% that saw the powertrain’s monthly market share fall by 8.4 percentage points to 32.1%.

“While BEVs saw the greatest year-on-year increase in market share, it still remains the third best-selling powertrain behind internal combustion engine and mild hybrid electric vehicles, clearly showing that more than 50% of EU markets still rely more conventional powertrain solutions – a clear signal of consumer sentiment that may influence the EU’s upcoming decision on the 2035 petrol and diesel car ban, a view also supported by countries such as Germany and Italy” said Daniele Minsteri, Senior Consultant at JATO Dynamics.

BYD continues to gain market share in Europe

Year-to-date, BYD recorded the strongest market share growth of any brand rising to 1.3%, up 0.93 percentage points, supported by an additional 102,000 registrations compared to the same period in 2024. Volkswagen-owned Cupra continued its upward trend, reaching 2.2% market share (+0.57 percentage points). This is in part due to the success of new models – the Terramar and Tavascan – launched under the Cupra brand which are replicating the success of the Formentor.

Meanwhile, Škoda also showed strong growth, with a year-to-date market share increase of 0.49 percentage points to 6.3%, mostly driven by the success of the Elroq and the new Kodiaq.

MG also performed well with registrations reaching close to 250,000 units, surpassing well-established mainstream brands including Nissan and Fiat.

“If we look at the year-to-date data for the fastest-growing Chinese or Chinese-owned OEMs in Europe, like MG, Omoda, or Jaecoo, we see that the share of pure BEVs is even lower than the market average. This clearly shows how these brands are leveraging both internal combustion and hybrid solutions to boost volumes, highlighting that Chinese competitiveness is not limited to pure-play electric vehicles. These brands are genuine challengers across other powertrains as well” Ministeri commented.

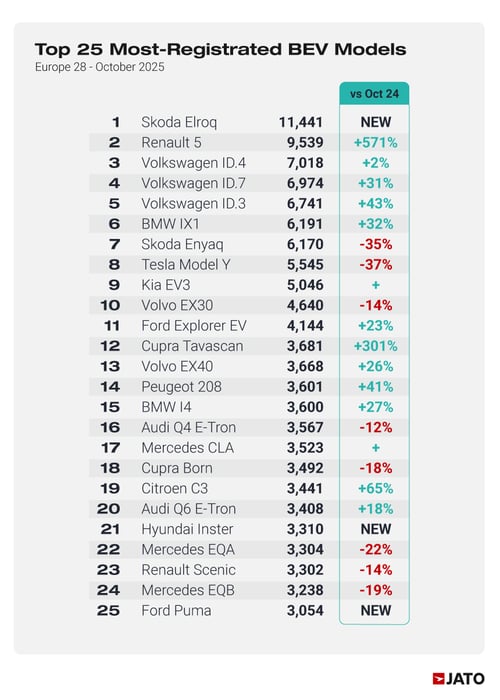

Within the BEV segment, the Tesla Model Y remains the best-selling model year-to-date with almost 115,000 units, followed by the fast-growing Škoda Elroq – October’s best-selling BEV model with 11,441 units and almost 71,000 units year-to-date. The Renault 5 followed in second place in October’s ranking, with 9,539 units registered last month.

“Despite all the rumours about a “Chinese BEV invasion”, there are no pure Chinese brands in the year-to-date BEV top ten. Volvo a Chinese-owned brand, appears in the ranking in tenth position followed by BYD in eleventh” Ministeri added.

For full rankings and detailed analysis, please contact us.

Contact:

Jack Sice, +44 7874 830 170, jatoteam@firstlightgroup.io

Daniele Ministeri, daniele.ministeri@jato.com

About JATO

JATO Dynamics is the world’s leading supplier of automotive business intelligence. Working across more than 50 countries, we deliver accurate analysis and trustworthy insights to support the industry.

Our specialist research solutions are designed to enable automotive businesses to thrive. Whether you need to compare vehicle specifications, optimise your digital marketplace offering, or identify regional trends, our range of customisable tools and reporting solutions can help. Visit JATO at www.jato.com for more information.

Let's support all your data needs.

Fill in the form and a member of our team will be in touch to explain the data in this press release in more depth, discuss your exacting requirements, and show how our bespoke consultancy solutions can help you meet your strategic goals.