The Brazilian automotive market has experienced a significant shift in consumer buying behaviour over recent years, fundamentally altering the competitive landscape. These changes have escalated dramatically with the entry of Chinese brands, which are reshaping the Brazilian market as we know it. Here, we analyse the current market trends and the journey that has led to this transformation.

The SUV transition

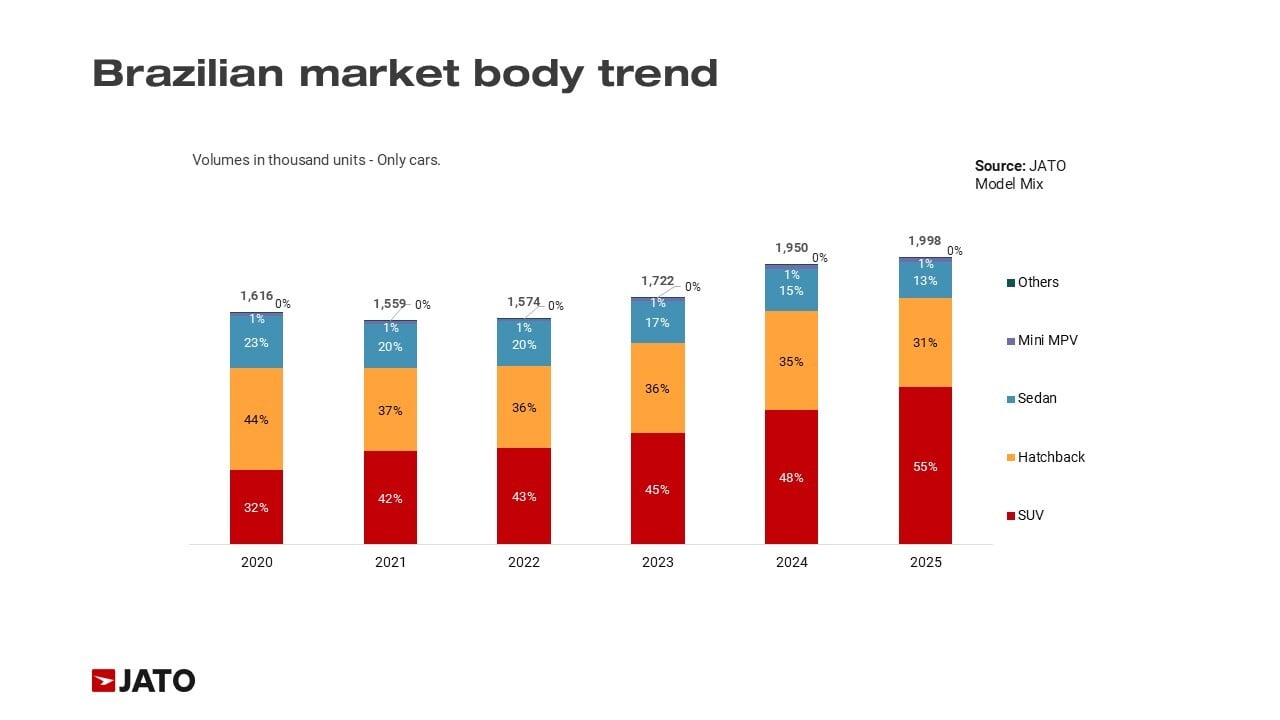

To understand the current market dynamics, we must first examine the dramatic shift in Brazilian consumer behaviour over the past five years. The market has experienced what can only be described as ‘SUV-isation’,a fundamental reorientation towards sport utility vehicles that has accelerated evidently since 2021. This body type has evolved from a niche preference to become the dominant choice for Brazilian car buyers, with SUVs surpassing all other body types in registrations for the first time in 2021. By 2025, SUVs represented an unprecedented 55% of total car registrations, marking a breakpoint moment for the Brazilian market.

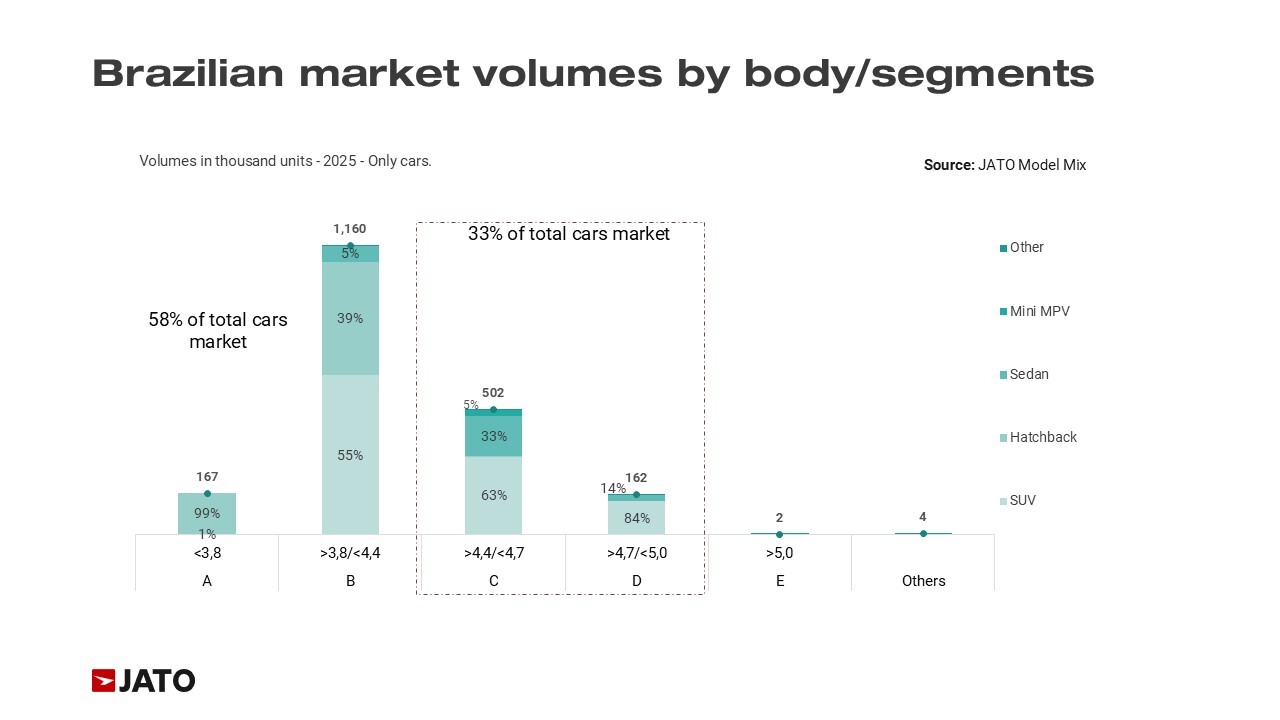

Analysing the current market composition reveals that the B segment remains the largest, accounting for 58% of total car registrations, whilst the C and D segments combined represent 33% of the market. However, the SUV dominance is particularly pronounced in the higher segments with 84% of D-segment vehicles being SUV, whilst SUVs constitute 63%of the C segment.

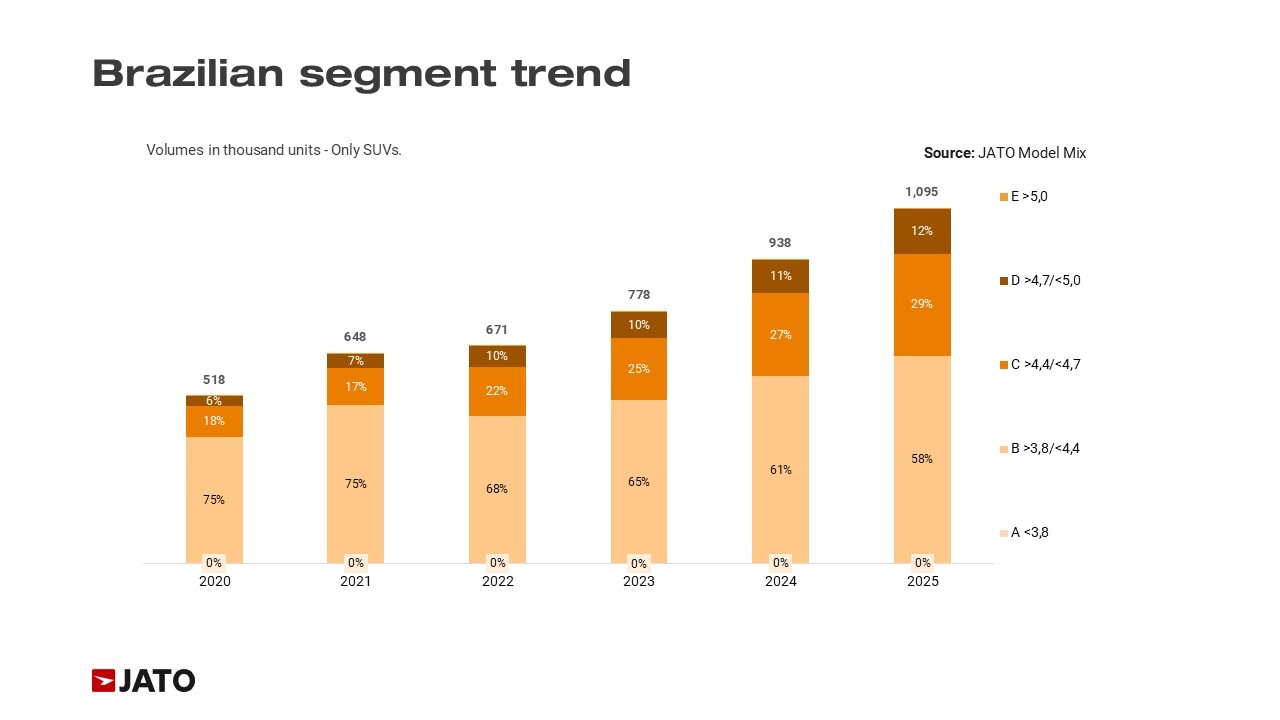

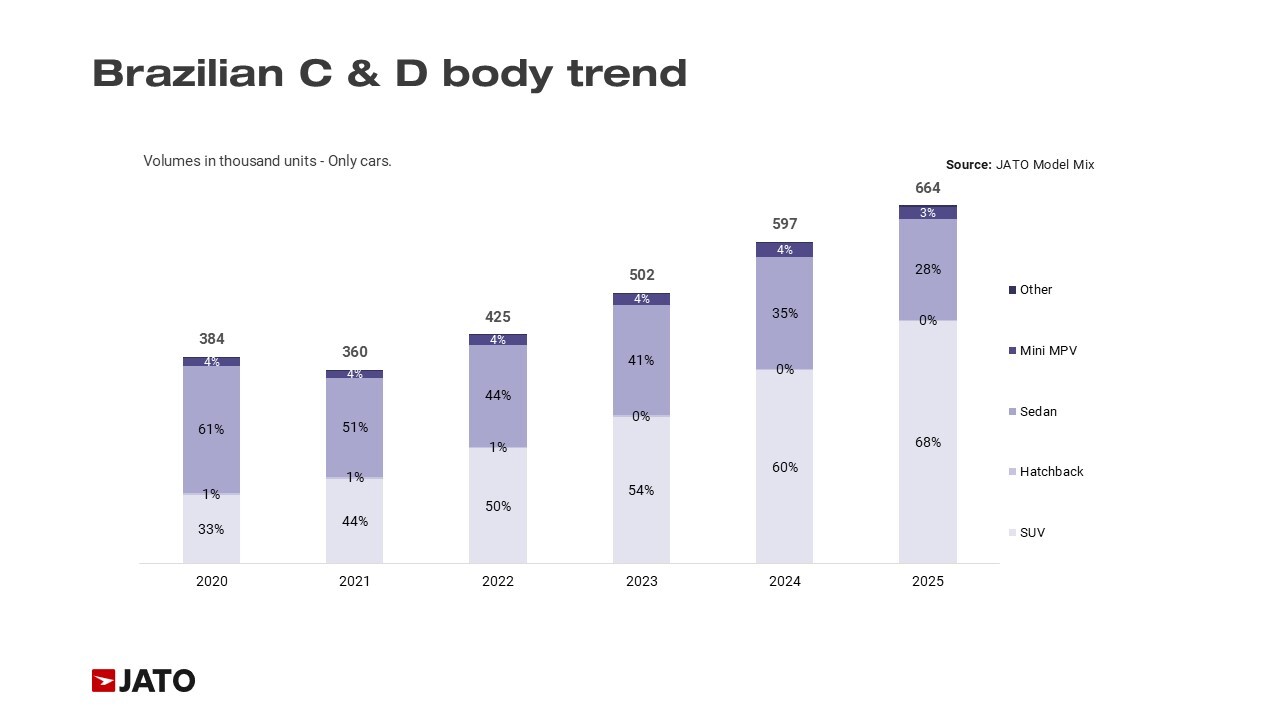

A deeper analysis of SUV registrations reveals a significant evolution within the segment itself. In 2020, B-segment SUVs commanded 75% of total SUV registrations. However, this share has steadily declined year-on-year, now standing at 58%, as higher segments (C and D) have gained substantial ground, rising from 24% to 41% of SUV registrations. Within the C and D segments specifically, SUVs have experienced remarkable growth, doubling their market share over the past five years from 33% to 68% – a rate of expansion exceeding the average across all other segments. Sedans have been affected the most from this shift, with their share plummeting from 61% to just 28% in these segments.

The Chinese brand phenomenon

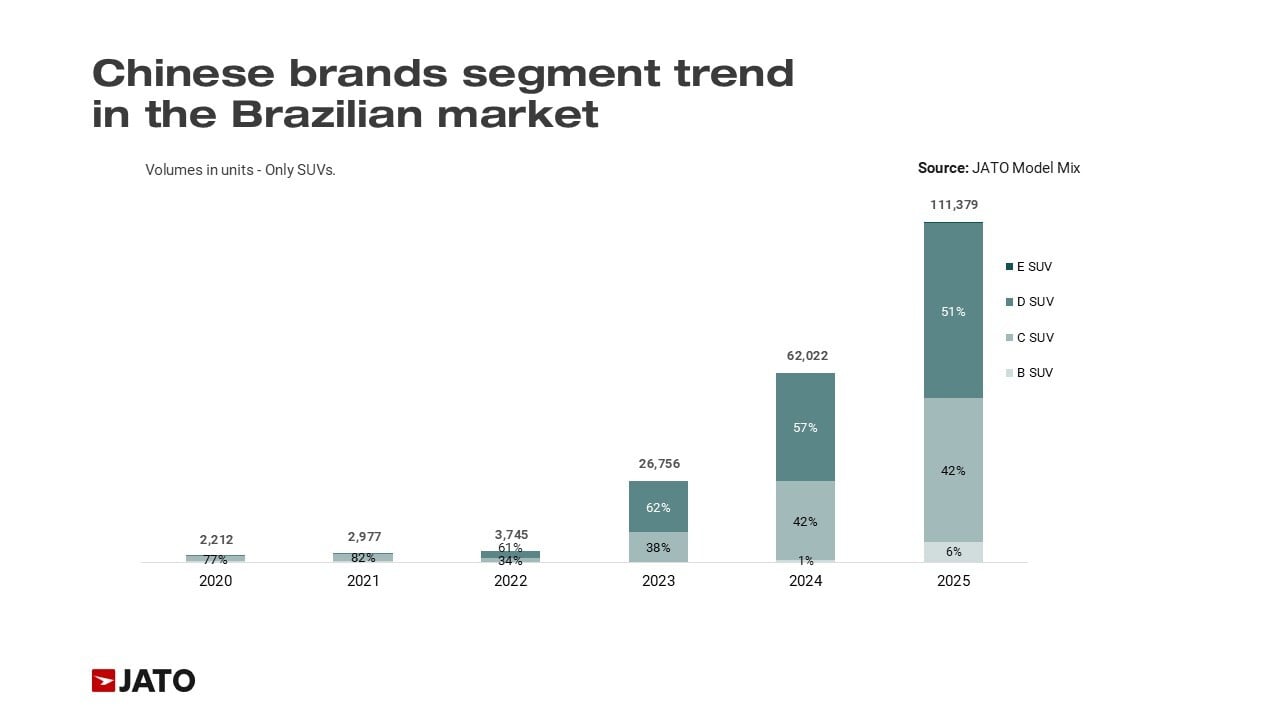

We can see precisely where Chinese manufacturers have made their decisive entry. Since 2023, registrations of Chinese SUVs have been doubling annually, with the C and D segments representing nearly the entirety of their success, currently accounting for 93%of total Chinese SUV registrations. It is this strategic focus that has allowed Chinese brands to maximise their impact in the fastest growing and most lucrative segments of the Brazilian market.

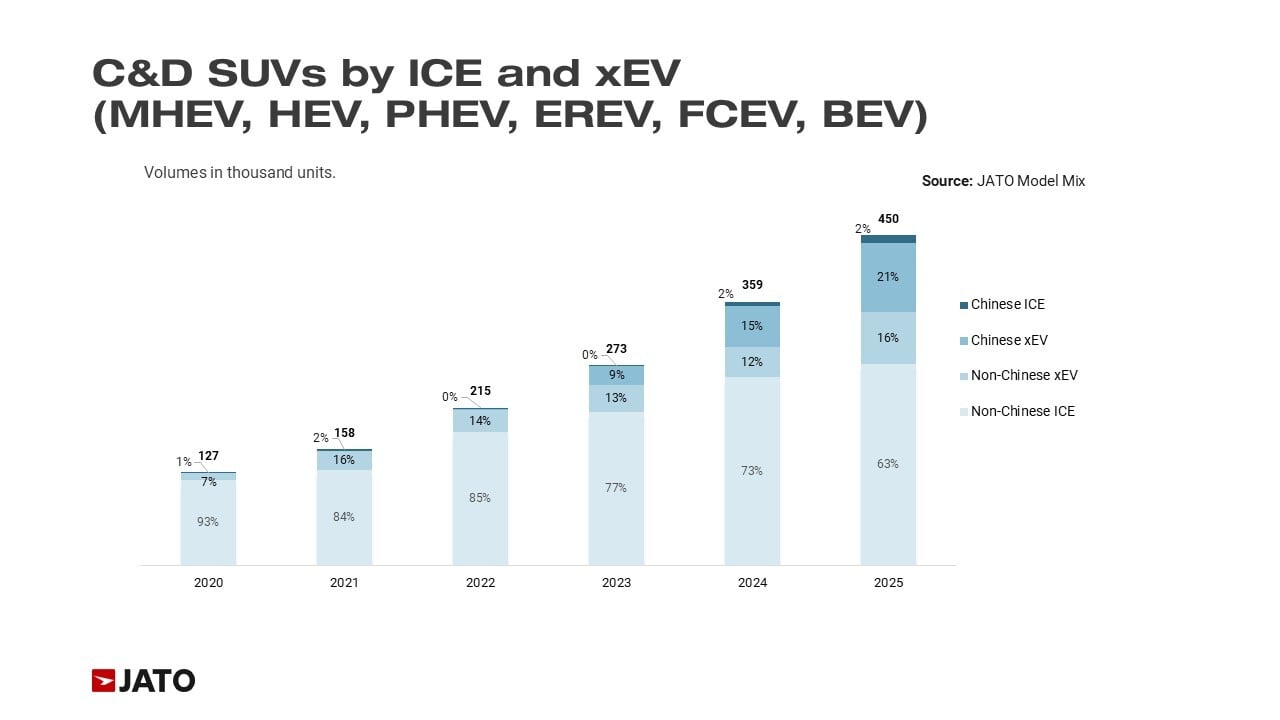

The success of Chinese manufacturers can be attributed to three fundamental factors: segment positioning, powertrain technology, and pricing strategy. The brands have systematically targeted positions previously dominated by traditional manufacturers who offered vehicles with limited technology and purely combustion engines. In contrast, Chinese automakers have introduced electrified powertrains at similar price points, disrupting the value proposition available to Brazilian consumers.

This strategic approach is clearly reflected in market data with year-on-year electrified vehicles (xEVs) growing and displacing purely combustion-engine vehicles in the C and D SUV segments. Chinese brands now represent 57% of xEVs in these segments, translating to 23% of total SUV registrations in the C and D categories.

Perfect pricing

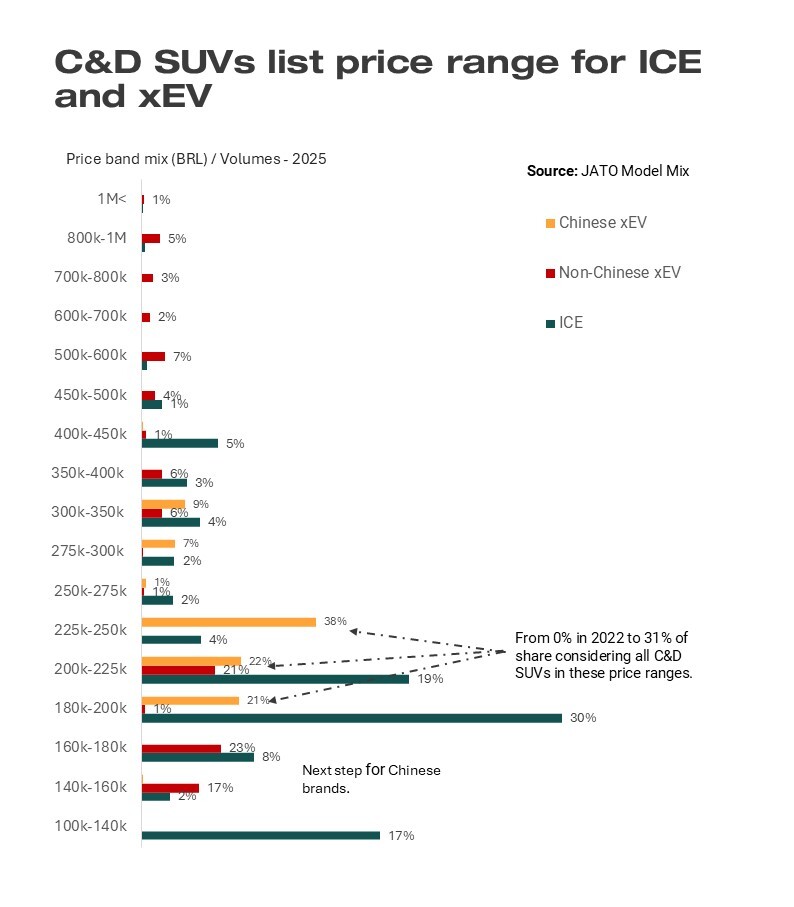

Pricing has proven to be the critical tactic in the Chinese manufacturers’ strategy. Before the arrival of Chinese brands in2022, the market exhibited clear segmentation. Internal combustion engine (ICE)vehicle registrations were heavily concentrated (62%) in the BRL 160,000 to BRL225,000 price range. While xEV registrations were dominated by premium brands priced above BRL 300,000, with some presence in the BRL 200,000 to BRL 225,000range (39% of xEV C and D SUVs), albeit in very modest volumes totalling just11,429 units. Crucially, there was virtually no xEV presence below BRL 180,000or in the BRL 225,000 to BRL 250,000 bracket, leaving significant market gaps.

|

|

Chinese brands identified and capitalised on these pricing gaps. They focused particularly on the BRL 225,000 to BRL 250,000range, where competition was virtually non-existent. This bracket now represents 38% of total Chinese xEV C and D SUV registrations. Furthermore, Chinese manufacturers have established a commanding presence in adjacent price ranges where xEVs had shown initial acceptance in 2022, now capturing 43% of registrations. Overall, Chinese xEVs now account for 31% of C and D SUV registrations in the BRL 180,000 to BRL 250,000 price range. The same pattern is emerging in lower price brackets, where xEVs (including Chinese offerings)are trending upwards despite ICE vehicles maintaining current dominance.

What’s next?

The impact of Chinese brands on the Brazilian automotive market has been profound and multifaceted. They have not merely entered an existing market structure, they have reshaped it by combining electrified powertrains with accessible pricing, filling gaps that traditional manufacturers had overlooked. In doing so, they have accelerated the trends of SUV-isation and electrification, while democratising access to advanced automotive technology. The next step in this strategy will be to dominate the lower price ranges, particularly the BRL 140,000 to BRL 180,000 bracket.

As these brands continue to expand their presence across additional price points, their influence on Brazilian automotive market trends will only intensify, potentially redefining what Brazilian consumers expect from their vehicles in terms of technology, capability, and value.

Gain a deeper understanding of market trends

If you want to understand current market dynamics and what the trends mean for your specific business, JATO Advisory can deliver the insights and intelligence you need.

With more 40 years of automotive expertise and real-time global data, our analysts work with manufacturers, suppliers, and dealers to make strategic decisions with confidence. Whether you’re evaluating regional strategies, optimising product portfolios, or planning for regulatory changes, our analysts can help you cut through the noise.

Book a call with our experts to discuss your priorities and how JATO’s data can support them.