The saying that ‘what you see is what you get’ could not be further from the truth when it came to how used cars were sold and financed in the UK market by car dealers via Discretionary Commission Arrangements (DCAs). DCAs allowed motor finance brokers or car dealers to adjust the interest rate on a car finance deal to increase their own commission — without telling the customer. Thanks though to investigations by the UK Financial Conduct Authority, it seems that the chickens have come home to roost as DCA complaints against car dealers by motor finance customers are now in full swing.

Lloyds Banking Group has earmarked £1.2 billion, while Santander UK has set aside £290 million, and Barclays has set aside £95 million to pay claims at set by the Financial Ombudsman Service around inflated motor finance charge rates levied on motor finance customers. Close Brothers has also made a provision of £165 million. These provisions are in response to British Financial Conduct Authority investigations into whether lenders and brokers acted fairly before the FCA banned DCAs in 2021, and whether car dealer customers were mis-sold finance agreements.

The new car segment is less at risk

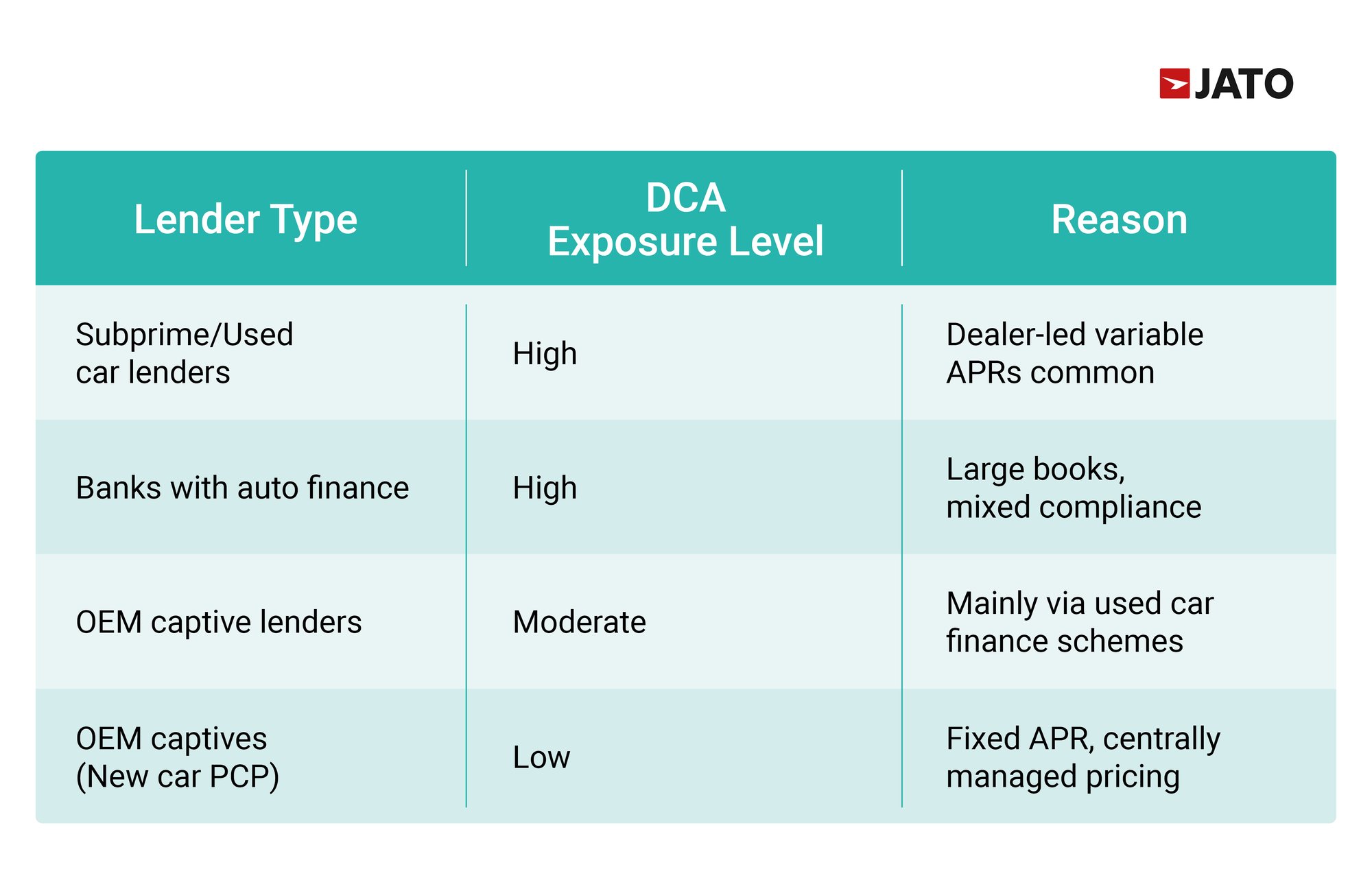

Original Equipment Manufacturer (OEM) Captive finance houses are not at the centre of (DCA) related risk of new car sales by car dealers. Most captives employed fixed APRs and centralised rate setting, particularly for new vehicle PCP offers that were part of national manufacturer backed promotional campaigns. This structure significantly limited dealer discretion in setting APRs and thus limited DCA exposure in the new car space. There are a few reasons for this.

Timing: Most new car finance deals from car dealers post-2021 levied on motor finance customers no longer included DCAs, since the FCA ban came into effect. So, any agreements made after that date are unlikely to be affected.

OEM captive finance practices: OEM captive finance arms — like those run by carmakers themselves — often had more standardised, transparent commission structures. They were less likely to use DCAs compared to independent brokers or third-party lenders.

Regulatory Compliance: OEMs tend to be more tightly regulated and risk-averse, especially when it comes to consumer finance. Many had already moved away from DCA-style models before the ban.

However, many captives also operate approved used car programs, where car dealer-led finance structures may have historically included variable commission models. This is where captives fear they will have exposure with Toyota Financial Services (TFS) amongst the latest to build in balance sheet liability cover. As a result, captives are now facing reputational and regulatory scrutiny, prompting them to enhance transparency across all finance channels, including new car finance as part of a broader trust-building exercise.

Market response reflected in PCP vs BoE spread trends

JATO Monthly Payments Solution (MPS) data reveals a persistent spread between average new car PCP (% APRs) and the Bank of England % base rates from January 2023 through June 2025. While DCAs were banned in July 2021, the financial and regulatory impact intensified in later years.

In early 2023, automotive finance spreads surged to +4.39%, highlighting a blend of post-pandemic pricing inertia and a prevailing appetite for risk-hedging among lenders. This period marked a crucial turning point, not only in financial behaviour but also in public sentiment.

Heightened media scrutiny and a wave of legal claims surrounding the Discretionary Commission Arrangement (DCA) scandal brought the issue firmly into the consumer spotlight, amplifying concerns about historic lending practices. According to the Financial Ombudsman Service, consumers with DCA-linked agreements may have overpaid by an average of £1,100 per £10,000 borrowed, with some multi-vehicle cases potentially exceeding £7,000 in redress.

Throughout 2024, the landscape grew more uncertain. Judicial proceedings gathered pace, including a landmark Court of Appeal ruling in October 2024 that expanded the scope of potential redress beyond DCA-specific cases.

The Financial Ombudsman Service launched a formal investigation in January 2024, and by mid-year, it had paused complaint handling deadlines to prevent disorderly outcomes while it assessed over 14 years of lending data. This climate of regulatory ambiguity reinforced a retreat to caution, with offer strategies favouring risk mitigation over growth. Lenders began provisioning for potential liabilities, and some OEM captives quietly adjusted commission structures to pre-empt scrutiny.

By mid-2025, spreads had narrowed to +1.85%, a sign of partial market correction. Yet PCP APRs remained elevated, often hovering above 7%, despite the Bank of England’s base rate falling to 4.25% following cuts in February and May. This disconnect suggests a mix of ongoing caution and margin preservation, likely influenced by unresolved legal exposure and conservative capital management. The FCA has indicated it may consult on a redress scheme by May 2025, with firms potentially required to proactively compensate affected borrowers.

Overlaying all of this was a broader macroeconomic shift: the UK’s easing inflation prompted the Bank of England to initiate a slow rate-cutting cycle. Inflation fell to 3.4% in May 2025, down from 11% at its 2022 peak. However, core inflation and wage growth remained sticky, and geopolitical tensions—particularly in the Middle East—kept energy prices volatile, complicating the monetary policy outlook. While base rates trended downward, the slower reduction in PCP APRs may reflect lenders’ conservative risk appetite, legal provisioning, or a delay in passing on reduced funding costs to consumers.

Taken together, these dynamics underscore a critical insight: while OEM captives may be shielded from the direct financial fallout of historical DCA arrangements, their current pricing strategies reveal an acute awareness of reputational risk, regulatory oversight, and the uncertain legal terrain still unfolding. With the UK Financial Conduct Authority’s next steps expected imminently and a Supreme Court ruling due by July 2025, the sector remains in a state of cautious recalibration.

JATO Monthly Payment Solutions (MPS): A transparency tool for the industry

JATO MPS delivers an essential toolkit for OEMs, Captives, and non-captives seeking to benchmark and optimise new car finance offers:

- Benchmark PCP offers across brands, versions, and time periods

- Analyse your market from a macro perspective down to your specific competitive basket

- Easily monitor market shifts and stay ahead of your competition

In a market where pricing scrutiny has increased, JATO MPS acts as a consistent yardstick to measure and compare finance terms and deliver successful pricing strategies.

Legacy issues in used car finance now shape new car lending behaviour

Although the financial liability of the DCA issue lies mainly in the used car sector, captive lenders face indirect consequences that are no less impactful. As highly visible entities, they are now expected to lead the market toward greater transparency and fairness in all private customer finance products including new car PCP offers. Regulatory and reputational concerns have influenced how captives set APRs, manage residual value assumptions, and construct their monthly payment offers.

JATO’s Monthly Payments Solution reveals how these influences manifest in real-world pricing trends, and how the legacy of DCA practices continues to shape the strategy and governance of new car finance in the UK.