European registrations surge by 21% in December with Tesla Model 3 the third best-selling car

- Artificial factors boosted December volume to a historical record

- Tesla Model 3 drives EV market growth and outshines competitors by becoming the third best-selling model

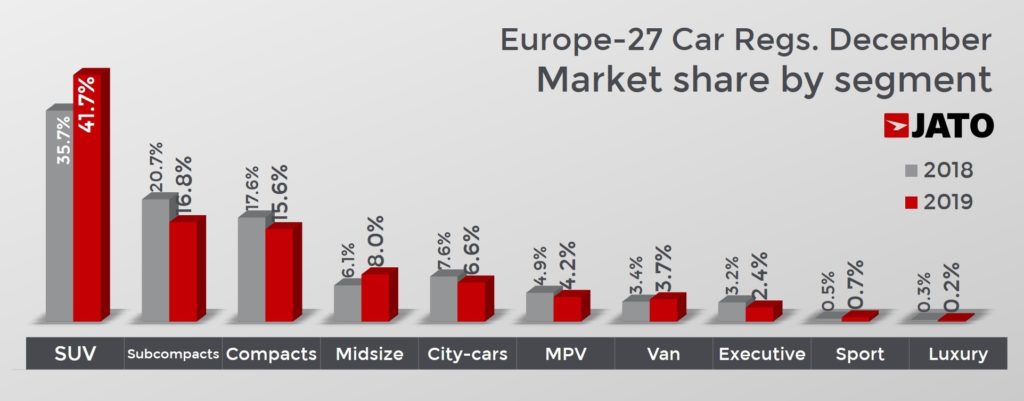

- SUVs registered their best ever market share, up by 20 percentage points compared to 5 years ago

December was another unpredictable month for European new car registrations. Total volume grew by 21% to 1,258,412 units, the highest level ever recorded for the month of December. Monthly growth levels have not been this high since August 2018, when the impact of the WLTP regulation caused an artificial spike. Similarly to August 2018, December’s growth can be explained by looking at new regulations impacting the industry. Last month, car manufacturers took last minute action to replace gas-guzzling vehicles no longer deemed acceptable under EU emissions regulations which came into effect on January 1st 2020.

The new regulations bring in a 95 gm/km target, which is still a long way off for many manufacturers who rushed for last minute registrations, and triggered the unusual growth. “The spike in registrations may initially look like good news, but JATO’s latest data tells a different story as emission levels have not improved for the big 5 markets. In fact, their volume-weighted average CO2 emissions through October 2019 totaled 122.5 g/km, which is 1.2 g/km higher than the result for the whole of 2018. The December registrations are an indication of the ongoing regulatory challenges facing car makers in the year ahead,” commented Felipe Munoz, JATO’s global analyst.

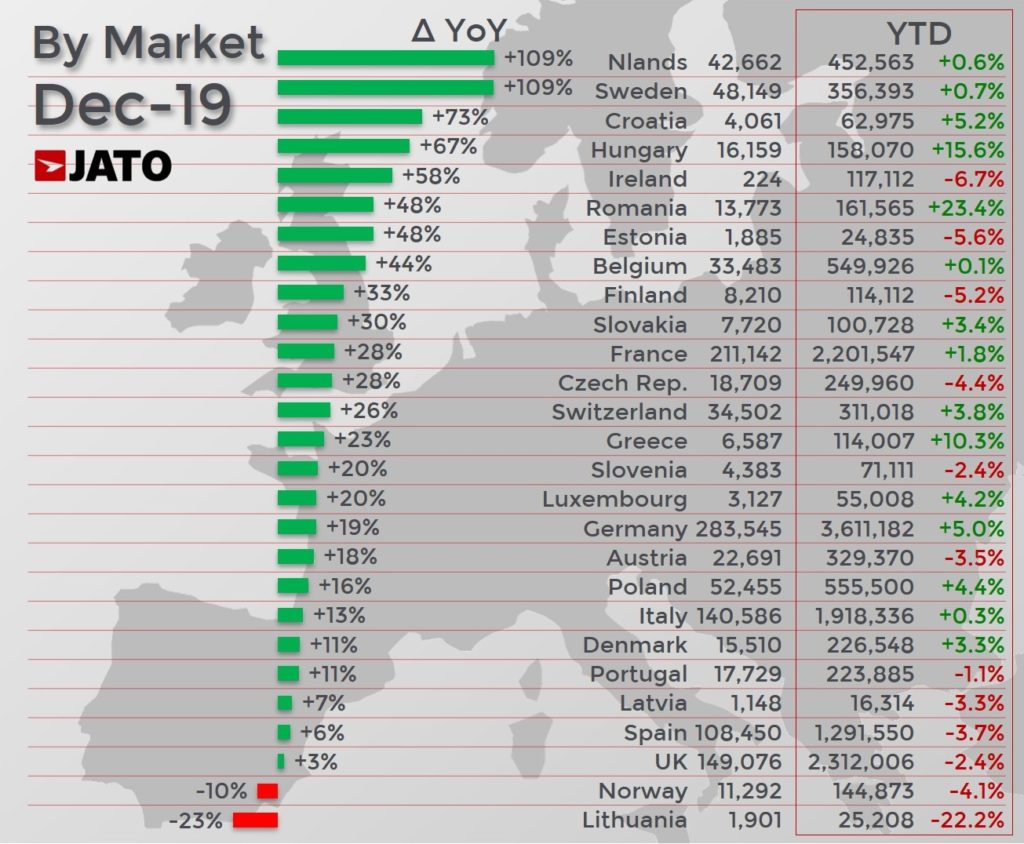

The country rankings tell a similar story, with registrations increasing in all countries except Norway and Lithuania, and 23 of the 27 markets analysed recording double-digit growth. “The growth is most likely due to self-registrations from those hoping to resell the units as second hand in 2020. For example, in Spain, where total registrations increased by 6%, the business registrations increased by 23% while private ones fell by 7%. In Finland, the former volume increased by 40% while the latter recorded only 3% growth,” explains Munoz.

SUVs registrations counted for 42% of total market

SUVs continued their strong performance in December with 524,500 units registered, or 42% of total volume. The result was 42% higher than the total recorded in December 2018. SUVs continue to be the main driver of growth in Europe despite their high contribution to CO2 emissions and risk of potential fines. Their market share jumped from 22% in December 2014 to 42% last month.

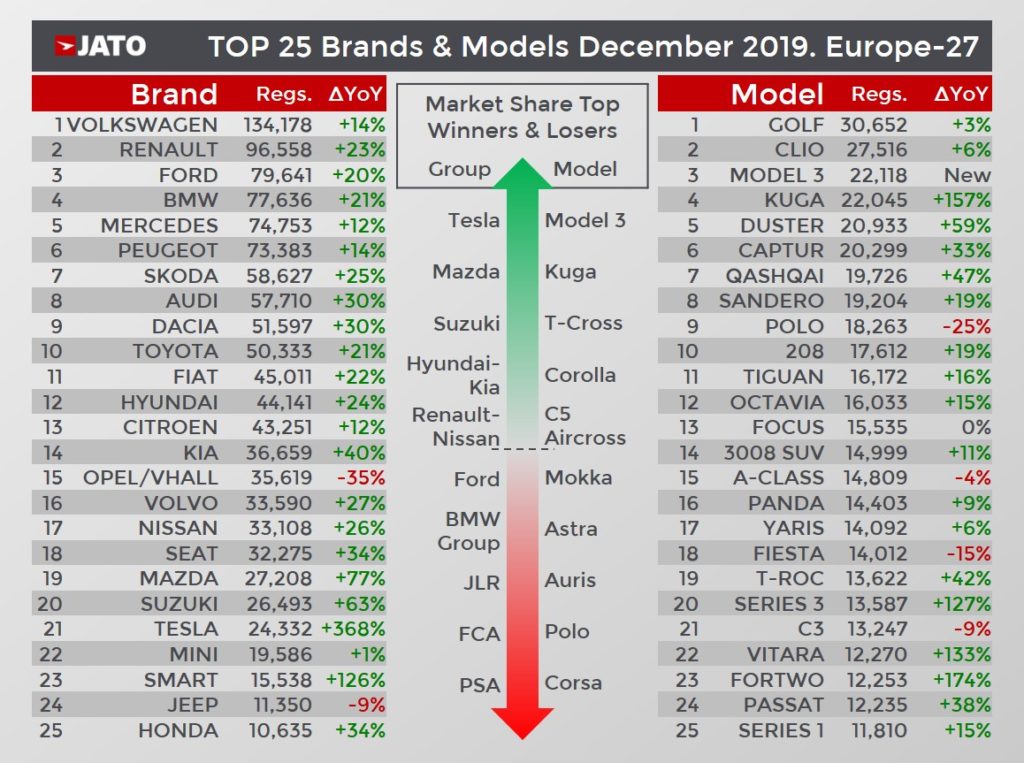

All SUVs, from small to luxury, posted double-digit growth in December. Volkswagen Group leads comfortably with a 72% increase in registrations. The German manufacturer holds 22% of this segment and has three SUVs in the top 10. Renault-Nissan and PSA take second and third place respectively. The Ford Kuga was the top-selling SUV, followed by the Dacia Duster and Renault Captur.

The Tesla Model 3 boosts the EV market and becomes the third best-selling model

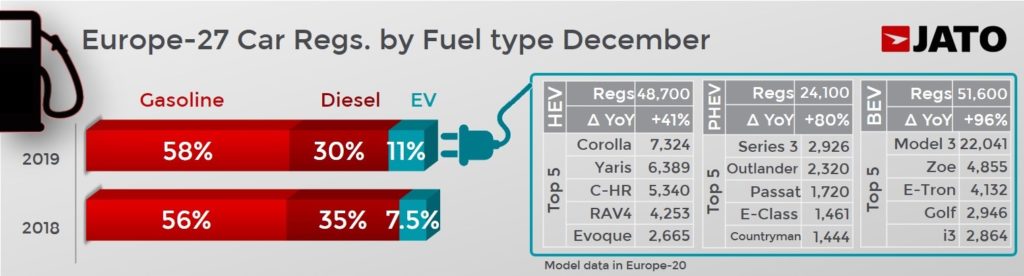

Electrified vehicles emerged as another big winner in December with demand soaring by 69% – equating to 132,200 units or 11% market share. In fact, the Tesla Model 3 was the most exciting performer of the closing month of 2019. With 22,100 units, it became the third best-selling model in the rankings, outselling other popular cars like the Volkswagen Polo, Peugeot 208, Nissan Qashqai and Skoda Octavia. Its volume made up 43% of the BEV registrations but it wasn’t the only star among the electric cars. The Audi E-Tron was the third best-selling BEV, and the Hyundai Kona BEV and MG ZS hit the top 10.

EVs are closing the gap at an impressive rate when compared to their diesel counterparts. In December 2018, there were 4.6 diesel cars for every EV sold; a year later the ratio has fallen significantly to 2.9. Most of this progress has been due to pure electric cars (BEV), which outsold hybrid vehicles (HEV) for the first time.

In December 2019, the BEV registrations totaled 51,600 units, up by 96%, while the HEV volume totaled 48,700 units, up by 41%. “As expected, Tesla continues to have an enormous impact on registrations at the end of each quarter and the Model 3 has put sedans back in the spotlight. The question is whether this trend is sustainable, or will electric SUVs hinder the popularity of Tesla Model 3 in the coming months?” states Munoz.

The general rankings also featured a few surprises. While the Volkswagen Golf maintained its leadership position, the Ford Kuga occupied the fourth position and was one of the four SUVs that hit the top 10. Volume grew by 127% for the new BMW 3-Series, 133% for the Suzuki Vitara, and 174% for the Smart Fortwo.

Among the latest launches, the Volkswagen T-Cross registered 11,200 units; the Toyota Corolla 10,800; Citroen C5 Aircross 8,700 units; Skoda Scala 4,800 units; Skoda Kamiq with 4,700; Mazda CX-30 with 4,500 units; and the Seat Tarraco with 3,000 units.

Download file: December 2019 Europe Reg Release - Final.pdf