U.S. new vehicle sales saw a slight increase in 2018 as SUVs continue to see market share growth

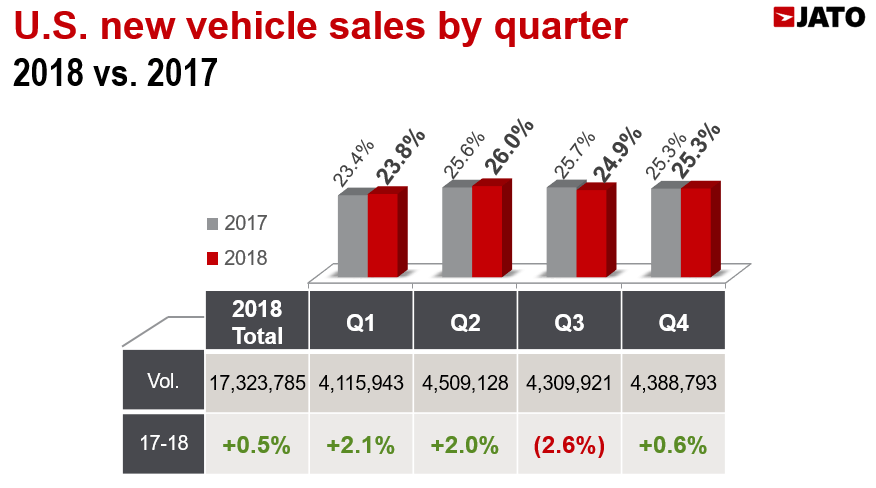

The American car market remained relatively stable during the 2018 calendar year with 17.3 million new vehicles being sold—an increase of 0.5% when compared to 2017. While only slightly outperforming the past year, 2018 was still one of the most successful years in terms of sales, becoming the fourth best year of all time behind 2016, 2015, and 2000. The positive year-over-year result was due to strong sales within the first two quarters of 2018 (+2.1% and +2.0%, respectively), overcoming a sizable decline in the 3rd quarter (-2.6%).

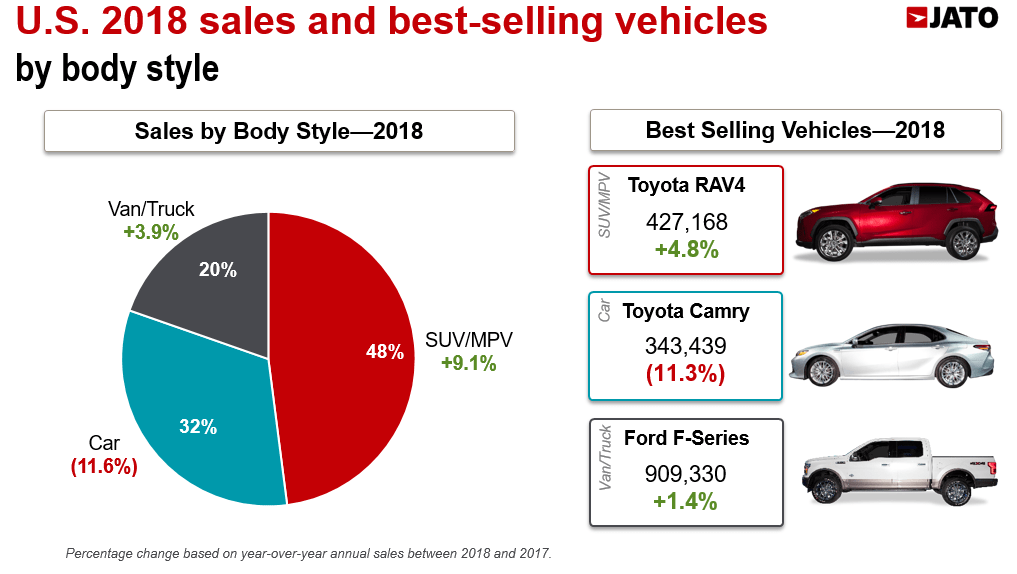

- 2018 saw a continuation of the American consumer favouring SUVs as the body style consisted of 48% of all new vehicle sales, an increase of 3.78 percentage points when compared to the previous year

- For the second straight year, the Toyota RAV4 was the best-selling SUV as well as the fourth best-selling vehicle overall in the US market. The compact SUV sold 427,168 vehicles through the year, a 4.8% increase year-over-year. Following the RAV4 were the Honda CR-V, Chevrolet Equinox, and Nissan Rogue

This increase primarily came at the expense of cars (e.g. sedans, coupes, convertibles), which declined from a 37% market share in 2017 to 32% in 2018.

- Despite declining 11.3% in year-over-year sales, the Toyota Camry was once again the best-selling car with 343,439 units sold. Rounding out the top five were the Honda Civic, Toyota Corolla, Honda Accord, and Nissan Sentra. Like the Camry, none of the top five saw an increase in sales year-over-year

- Trucks continue to play a major part of the U.S. market, selling over 3.4 million vehicles — an increase of over 100,000 vehicles when compared to the previous year

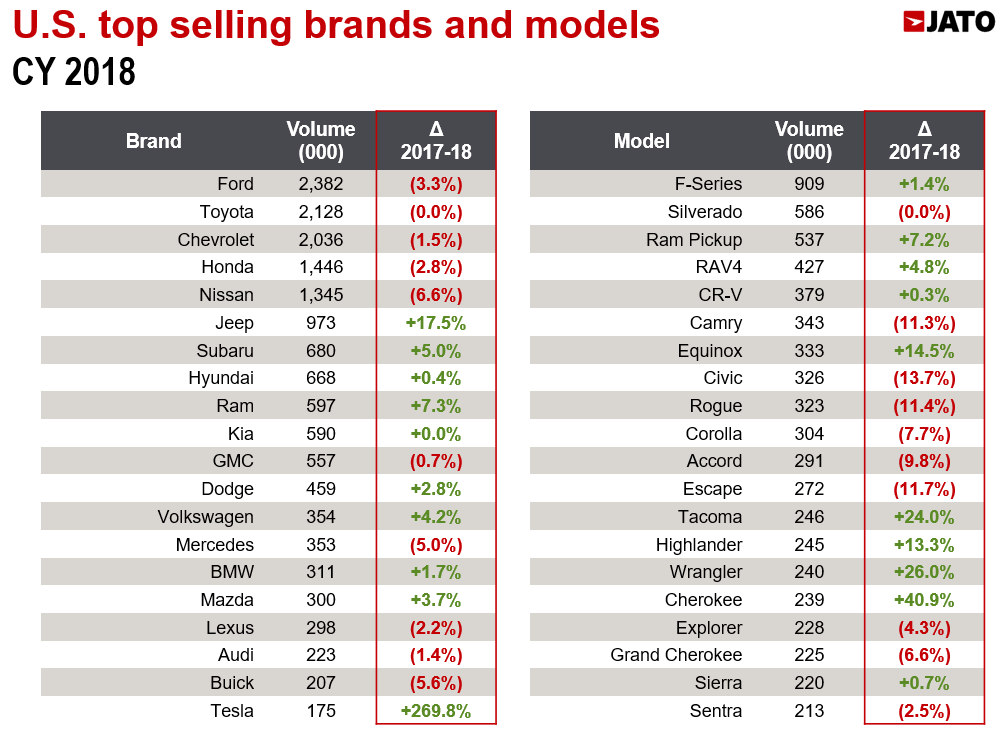

- The F-Series continues to be the best-selling vehicle in the United States, selling 909,330 trucks in 2018. If the F-Series was a brand, it would be the seventh best-selling one, falling in-between Jeep and Subaru (973,227 and 680,135 sales respectively). Following the F-Series were the Chevrolet Silverado and Ram Pickup, which both sold over 500,000 units throughout the year

Despite seeing a decline in sales year-over-year, Ford remains the United States’ top brand, selling just under 2.4 million vehicles throughout the year. Their pole position can be attributed to the F-Series, while other best-selling Ford vehicles saw declining sales: Escape, Explorer, and Fusion. Chevrolet and Toyota were second and third respectively, with both brands selling more than 2 million vehicles for the 5th straight year.

The biggest winners in market share growth were Jeep and Tesla, gaining 0.81 and 0.73 percentage points respectively. While Tesla’s gains can be attributed solely to the increased production of the Model 3, Jeep had a team effort as the Wrangler, Cherokee, and Compass all saw significant increases in sales year-over-year. This overall gain is even more impressive when taking into account that one of their models, the Jeep Patriot, ended its run in late 2017.

Looking Ahead

- With the current economic uncertainty from both within and aboard, one has to wonder if 2019 will continue to plateau or if this will start a mid-to-long term decline

- 48% of all new vehicle sales in 2018 were either SUV or MPVs, an increase of 3.78 percentage points when compared to 2017. If this trend continues, 2019 will be the first year that SUV/MPVs make up a majority of new vehicle sales in the United States

- Despite selling a major majority of their vehicles during the second half of the year, Tesla’s Model 3 was the best-selling premium vehicle in 2018. Assuming demands hold and Tesla does not have an issue with production, the Model 3 could become a top 25 best-selling vehicle in 2019

- In September 2018, Audi failed to increase their monthly sales year-over-year after 107 months. The longest streak for monthly year-over-year is currently held by Subaru (started in December 2011). Will 2019 be the year Subaru’s streak breaks?

More Articles

- European Car Registrations up by 7.1% – the best September monthly Sales performance for a decade

- European car registrations increased by 5.2% in November, as SUVs posted record market share

- PSA-Opel lost market share, as European car registrations increased by 1.2% in February 2017

- Brazil, Argentina, Chile and Ecuador drive growth in Latin American car market during Q1 2018

- European registrations surge by 21% in December with Tesla Model 3 the third best-selling car